Ever dreamt of making money while you sleep? You’re not alone.

Believe it or not, a recent poll found that 20% of Americans earn $4,200 in passive income per year. Not too shabby, right?

Well, imagine earning an extra $1,000 a month without lifting a finger (after the initial setup, of course). It sounds like a dream, right? And here’s the good news: it’s totally doable.

This isn’t just about lounging on a beach somewhere (though, that’s a nice perk). It’s about securing financial freedom, building an asset that works for you, and achieving that work-life balance we all want.

So, how exactly do you make $1,000 a month in passive income?

Let’s dive deep and get you on that path to passive profitability.

The Power of Passive Income

Alright, let’s get one thing straight: passive income isn’t about getting something for nothing. Nope. It’s about smartly setting up assets so they pay you automatically.

I’ve seen people make the mistake of thinking that passive income is easy and simple. It takes work, but when done right, it will make you money around the clock.

What are the benefits of creating passive income streams, you ask? Here are a few:

- Hands-Off Earnings: Did you know the average millionaire has seven sources of income? Yeah, they’re not grinding at all of them 24/7. A big chunk comes from – you guessed it – passive streams. Once set up, these sources need minimal intervention, letting your bank balance grow while you focus on other ventures (or binging Netflix).

- Financial Safety Net: Recessions. Job losses. Unexpected bills. Life gives you curve balls. With passive income, you’ve got a safety net. I love the feeling of security that my businesses give me. On top of my full-time job, extra cash trickles in daily.

- Flexibility & Freedom: Always wanted to travel the world? Or maybe just avoid rush hour? Passive income lets you decide your daily rhythm. No 9-to-5 grind.

- Grow Wealth Faster: Compound interest is the secret to building wealth. Earning from investments or digital assets? That’s money you can reinvest. Over time, this cycle doesn’t just add to your wealth; it multiplies it.

Getting Started Towards $1,000/Month Passive Income

You’re hyped about passive income. But… where do you start? Before you hop on the next “get-rich-quick” fad, let’s do some foundational work.

- Inventory Check: What skills, talents, or resources do you already have? Maybe you’re a killer graphic designer, have a knack for spotting real estate gems, or you’ve amassed some savings.

- Research is Gold: Riches are in the niches as they say. Spend some quality time on Google looking at trends, gaps, and demands. You can also spot them on social media or in everyday life.

- Set Clear Goals: I can’t stress this enough. Wanting to “make more money” isn’t enough. Be precise. You’re here to make $1,000 a month in passive income, right? Keep your eyes on that prize. Use tools like the SMART goal framework to carve out a clear path.

- Chat with the Pros: Networking isn’t just for regular jobs. Being around the right people can help take your income and success to the next level. So, slide into those DMs, join forums, or attend webinars.

- Start Small, Dream Big: Rome wasn’t built in a day. And neither will your passive income. It’s tempting to dive into big investments or complex projects, but it’s smarter to dip your toes first. Small wins lead to big victories.

8+ Ways to Make $1,000/Month Passive Income

Now, let’s get into the fun part of the article: passive income methods that earn $1,000+ per month.

1. Dividend-Paying Stocks

Have you ever wanted to invest in the stock market? Well, it can help you get closer to that $1,000/month passive income goal. Specifically, I want to introduce you to stocks that pay dividends. It’s like getting a slice of a company’s profits just for holding onto their shares.

In layman’s terms? It’s a company saying “thanks for believing in us” by sharing a piece of its profits with shareholders. Some companies dish out these payments quarterly, while others might do it annually.

You don’t have to be a part of the company or do any extra work other than holding on to your shares. That’s it. And, the more you reinvest, the more compound earnings you gain.

If you’re new to investing, start with safe companies AT&T, Shell, or Bank of America for example. These are strong businesses that have a healthy history of dividend payouts and increases.

And, thanks to platforms like Robinhood, getting your hands on these stocks is simple and commission-free.

Want to supercharge your passive income with this method? Consider a DRIP (Dividend Reinvestment Plan). Instead of pocketing the dividends, they automatically buy more shares.

If you’re going this route, make sure to stay on top of the market, too. The market changes. Companies evolve. Read finance news, join investor forums, and maybe even set up Google Alerts for your stocks.

2. Real Estate & REITs

You could probably guess that real estate would make my list. I’m not just talking about flipping houses or playing landlord, though—we’re diving into the world of REITs.

First, the basics. REIT stands for Real Estate Investment Trust. In short, they’re companies that own or finance real estate, and they place it for sale on stock exchanges. When you buy REIT shares, you’re essentially getting a slice of that real estate pie. All without the headaches of managing a physical property.

Here’s what makes REITs so great: By law, they’re required to distribute at least 90% of their taxable income to shareholders. That means hefty dividends for you. Some REITs have been known to offer yields north of 5%!

There’s also good diversity in terms of what kind of properties you can invest in. From malls and hotels to data centers and forests, REITs come in all flavors. You can invest in diverse real estate portfolios without the usual landlord headaches or hefty down payments.

I recommend using a platform like Wealthsimple. It’s easy and free to get started, and you’ll be on your way to buying REITs quickly. Some you can research include:

- Diversified Healthcare Trust.

- SL Green Realty Corp.

- Uniti Group Inc.

- Vornado Realty Trust.

- Industrial Logistics Properties Trust.

3. Self-Publishing E-Books

This is a fun one I have experience with. Currently, I make a few hundred per monthly passive with old e-books I published years ago. Frankly, they need some work, but they still bring in decent cash. If you have knowledge about a particular topic, you can turn it into a book to sell on platforms like Amazon.

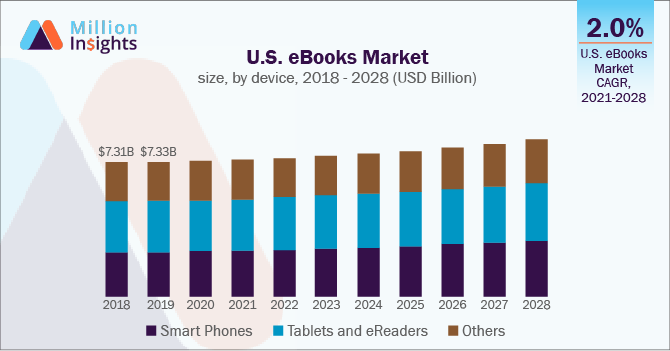

In fact, the U.S. e-book market is worth billions of dollars and growing each year! You can get a chunk of that as a self-published author.

The first step is deciding on your niche. This can be primarily fiction or non-fiction depending on your skills and interests.

Research on Amazon and other marketplaces what books are selling and which topics are in demand. Use tools like ChatGPT to come up with ideas that are unique and stand out.

Once you decide on a topic, it’s time to write the outline of your book. Include a blueprint for all of the chapters and the main takeaways. Again, artificial intelligence is your friend to save time.

Take the time to write it and be patient. It could take weeks, months, or years to finish a book because of a variety of factors. And, a killer e-book isn’t just about content. It’s about presentation. Use platforms like Canva for design and Grammarly for editing.

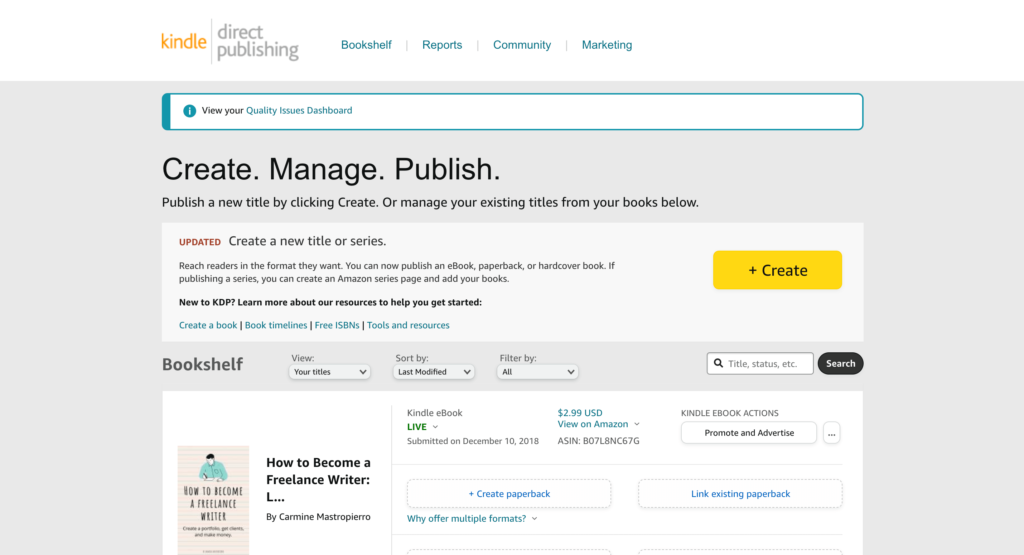

Once your e-book is ready, where do you upload it? Amazon Kindle Direct Publishing is my favourite, with authors earning up to 70% in royalties. You can also sell it directly on your website if you wish.

Once your book is live, you’ve got to make some noise. Share snippets on social media, collaborate with influencers, or maybe even run a few ads. And here’s a pro tip: Collect email addresses. Offering a free mini e-book in exchange for emails? Gold. That list becomes your core audience for future e-books and projects.

4. Online Courses and Education Are Booming

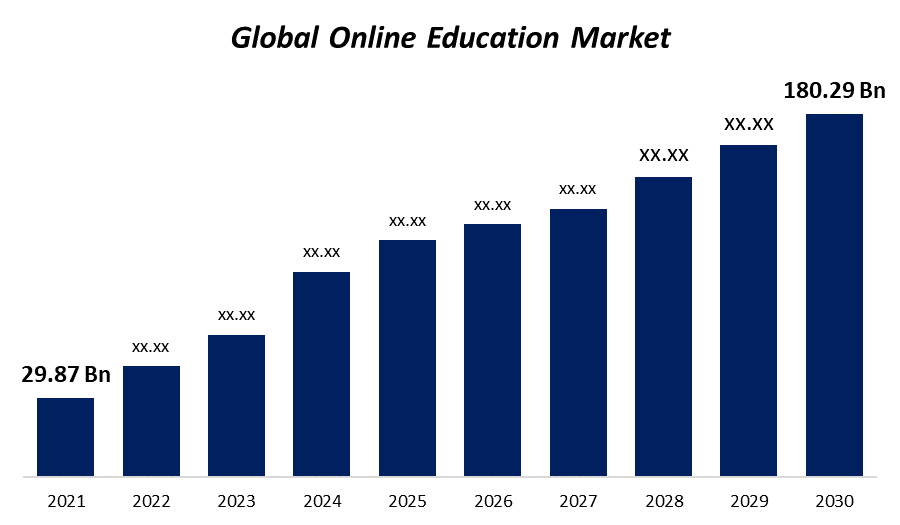

This is the main way I make money with my brand and surpass the $1,000/month passive income mark. The online education market is exploding and was valued at USD 29.87 Billion in 2021!

My question for you is: what can you talk about for hours without getting bored? That’s your expertise. Whether it’s basket weaving, SEO tricks, or yoga for pets, there’s an audience eagerly waiting. The more niche, the less competition.

For example, I’ve sold copywriting and marketing courses for years and have made six figures. At the time of this article, I am pivoting into self-development courses to teach my students other topics I’m passionate about.

The point is you don’t need a 100-hour course to succeed. Sometimes, a focused 2-hour masterclass can outshine the long-winded ones. Focus on actionable steps, clear takeaways, and tangible results. Oh, and video quality? Non-negotiable. Good lighting and clear audio can make or break your course.

I personally use Teachable because of its customization, ease of use, and integrations. Some platforms offer massive audiences (I’m looking at you, Udemy) but take a cut. Others, like Teachable, give you more control. Weigh the pros and cons, and pick your stage.

Similar to how we made an e-book, creating a course is similar:

- Map out the course curriculum with all of the modules and lessons students can take.

- Add exercises, PDFs, worksheets, quizzes, and other resources that will help them learn.

- Create a roadmap that students can follow from a beginner to an expert on the topic.

- I also suggest including coaching or a relationship with you as the instructor.

- Add a community feature using Discord or a private Facebook group.

Once you have published your course, it’s time to get marketing. Post content on social media, start blogging, or create an affiliate program to get referral traffic. And once the course is rolling, gather feedback. Tweak, refine, and relaunch. The best courses are those that evolve.

5. Use Affiliate Marketing to Earn Passive Income

One of the most truely passive ways to make $1,000/month is through affiliate marketing.

At its core, affiliate marketing is recommending products or services and getting a commission for each sale made through your unique link. No creating products, dealing with customer service, or anything like that.

Over 81% of brands leverage affiliate marketing, as well. This means that most businesses you come across or enjoy yourself can become a way to generate passive income.

Keep in mind that not all affiliate programs are created equal. Amazon Associates is one of the most popular, but there’s also ShareASale, CJ Affiliate, and countless others. Pick one based on your niche, audience, and what you truly believe in. Authenticity = conversions.

I strongly believe that blogging and SEO is the best way to drive traffic to affiliate offers. As you get more organic traffic to your blog posts, your affiliate income compounds. The entire system becomes automated and passive.

You can do product reviews, comparisons, and how-to guides. The more value you give and problems you solve, the higher the chances your audience will click and buy.

YouTube is also a great way to run an affiailite marketing business. You can make videos about a certain topic and include affiliate links in the description to your camera gear or what you are speaking about in the video.

5. Create a Print on Demand Clothing Business

Okay, ever dreamt of running your own fashion line or art store but got scared away because if the logistics? Enter: Print on Demand.

With this $1,000 passive income method, you create designs, slap them onto products (like t-shirts, mugs, or posters) and when someone buys? The platform prints, packs, and ships. You? Just chill and watch the cash roll in.

No design skills? No problem. Tools like Canva and Midjourney can quickly help create you eye-catching designs. And if you’re willing to invest a bit, platforms like 99designs can connect you to freelance pros.

In terms of what platforms to use, Printful, Teespring, and Vistaprint are some good options. Some give you more profit per sale; others bring in organic traffic. Research them based on your needs and make an informed buying decision.

That brings me to my next point.

6. Dropshipping and E-Commerce

Ah, good ole’ dropshipping. You’ve probably come across social media gurus telling you how much money you can make with this business model. Sure, it has potential, but it’s not a get rich quick scheme. Like anything, you have to study and work hard to hit that $1,000/month mark.

I’ve run a few online stores that made me $3,000-$4,000/month profit back I was around 20 years old. Nothing crazy, but it felt like millions of dollars at the time.

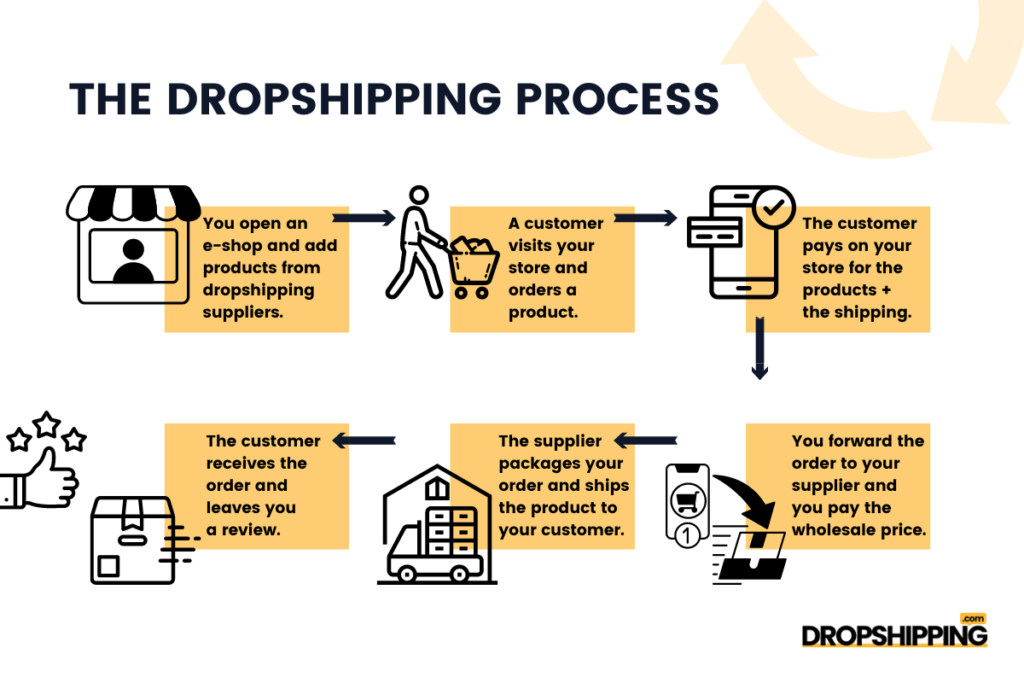

How does dropshipping work? It’s pretty simple. A customer orders from your online store. Your supplier gets the memo, packs, and ships. You? Just kick back, enjoy the profits, and prioritize customer service. No inventory, production, or massive overheads.

Niching down is very important with e-commerce. You can’t (and shouldn’t) sell everything. Focus on a niche that gets your heart racing. Vintage watches? Eco-friendly gadgets? Go deep, not wide. The more specialized, the less competition you face.

You have a couple of options for finding a supplier. Platforms like Oberlo or SaleHoo can help you out a lot. Strike a balance between good profit margins, fast shipping, and quality products.

Dropshipping’s a bit of a double-edged sword, however. Low overheads, yes. But you’ve gotta be on your marketing A-game. Facebook Ads will be your best friend. Study how to make creatives, set up campaigns, and constantly optimize your ads. Watch my video to learn more.

7. Make $1,000/Month Passively With Mobile Apps

Have you ever been scrolling on an app and thought, “Man, I wish I thought of that!”? Good news: there’s still an opportunity to develop mobile apps and bring in some cash every month.

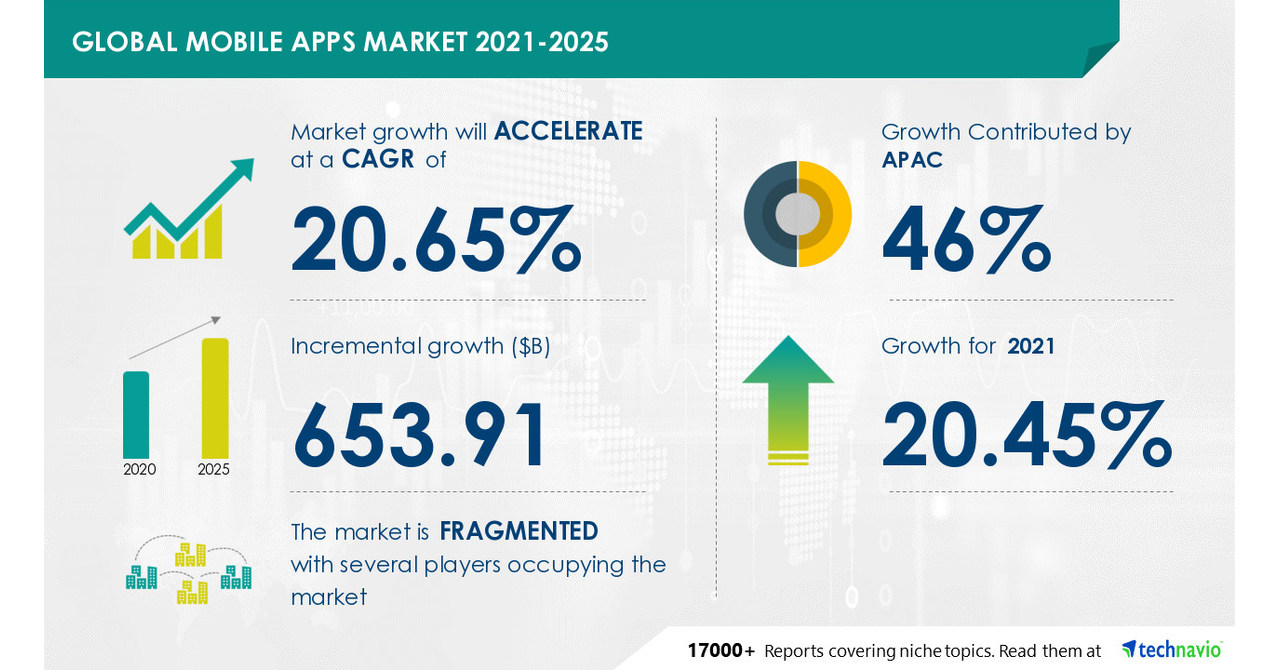

The global app economy is worth $653 billion. Yes, you read that right. And with people spending hours per day on their phones, there’s plenty of screen time to capture.

The best apps aren’t about hard selling; they’re about hard problem solving. Got a daily annoyance or a see a trend in the market? There’s probably an app solution waiting to be born. It’s about finding those little gaps and filling them.

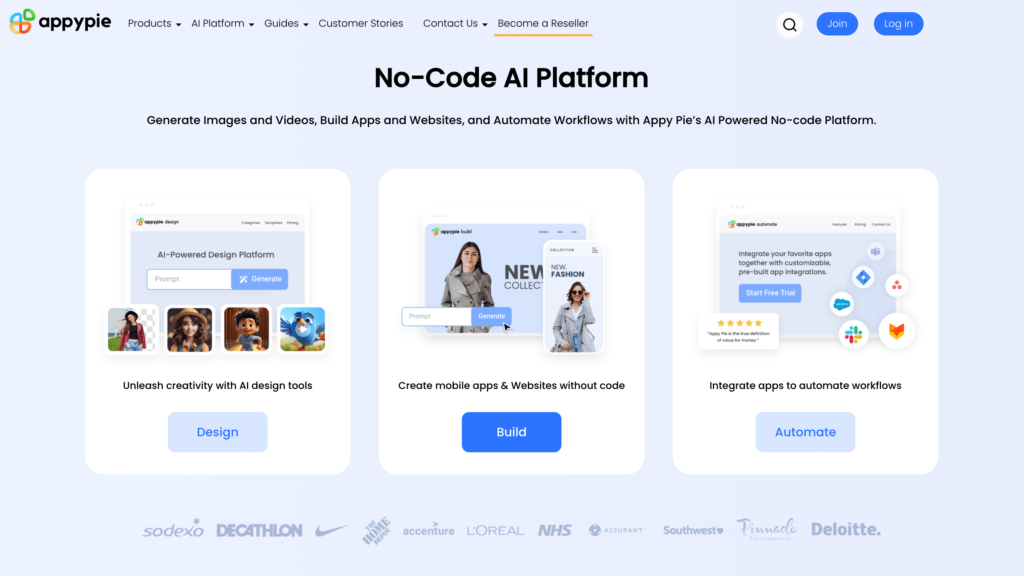

Not a coder? No sweat. Platforms like Appy Pie let you create an app with zero coding skills. But if you’re dreaming big (think the next Uber), it might be worth partnering with a seasoned developer.

In terms of monetization, free apps with in-app purchases are common. You can also do paid apps, make money off ads, or create a subscription model. The monetization options are vast.

Learn about ASO (App Store Optimization) to make your app stand out in the store. Engage with reviews, drum up buzz on social media, and post it on places like Reddit and Product Hunt.

Honorable Mentions For Making $1,000/Month Passively

I dove in deep to the main ways to make $1,000/month in passive income, but I wanted to share an extra list to give you inspiration. Enjoy.

8. Peer-to-Peer Lending: Invest in peer-to-peer lending platforms where you can lend money to individuals or businesses and earn interest on your investment. These platforms connect borrowers with investors, allowing you to earn passive income through interest payments.

9. Renting Out Equipment or Property: If you own equipment or property that is not in use all the time, consider renting it out to generate passive income. This could include renting out camera gear, tools, storage space, or even renting out a room or property on platforms like Airbnb.

10. Investing in High-Yield Savings Accounts or CDs: Park your money in high-yield savings accounts or certificates of deposit (CDs) to earn passive income through interest payments. While the returns may be lower compared to other investments, they offer a low-risk way to earn passive income.

11. Investing in Royalties: Purchase royalties from creative works such as music, books, or patents to earn passive income from ongoing royalties. Platforms like Royalty Exchange allow investors to buy and sell royalties from various creative assets.

12. Creating and Licensing Intellectual Property: Generate passive income by creating and licensing intellectual property such as patents, trademarks, or copyrighted works. Licensing your intellectual property to companies or individuals can provide ongoing royalties without active involvement.

13. Investing in Crowdfunded Real Estate: Explore crowdfunded real estate platforms that allow investors to pool their money to invest in real estate projects. These platforms offer opportunities to earn passive income through rental income or property appreciation.

14. Automated Trading Systems: Invest in automated trading systems or algorithms that trade stocks, cryptocurrencies, or forex markets on your behalf. While there are risks involved, automated trading systems can generate passive income through trading profits.

15. Creating and Selling Digital Products: Create and sell digital products such as templates, e-books, stock photography, or digital courses to earn passive income. Once created, digital products can be sold repeatedly without the need for ongoing maintenance.

16. Investing in Business or Real Estate Crowdfunding: Invest in business or real estate crowdfunding opportunities through platforms like Kickstarter, Indiegogo, or Fundrise. These platforms allow investors to contribute to projects and earn passive income from returns or dividends.

17. High-Yield Bond Funds: Invest in high-yield bond funds or ETFs (exchange-traded funds) to earn passive income through interest payments. These funds invest in bonds with higher yields, offering potential for higher returns compared to traditional bonds.

18. Vending Machines: Invest in vending machines and place them in high-traffic areas such as malls, airports, or office buildings. Earn passive income from the sales of snacks, beverages, or other products without the need for active management.

19. Storage Unit Rentals: Purchase or build storage units and rent them out to individuals or businesses looking for storage space. This passive income method requires initial investment but can generate consistent rental income over time.

20. Outdoor Advertising Space: If you own property with high visibility, consider leasing outdoor advertising space to businesses for billboards, banners, or signage. Earn passive income from advertising fees without the need for ongoing maintenance.

21. Parking Space Rentals: Rent out parking spaces or driveways in urban areas where parking is limited. Platforms like JustPark or SpotHero allow property owners to list their parking spaces for rent, providing passive income from parking fees.

22. Laundry Facilities: Install coin-operated laundry facilities in multi-unit residential properties or apartment complexes. Earn passive income from laundry fees paid by tenants without the need for active management.

23. Car Wash Facilities: Build or invest in automated car wash facilities and generate passive income from car wash fees. These facilities require initial investment but can provide ongoing passive income with minimal maintenance.

24. Online Content Syndication: License your digital content, such as articles, videos, or photography, to media outlets, websites, or content aggregators for syndication. Earn passive income from licensing fees or royalties each time your content is used or distributed.

25. P2P Car Sharing: If you own a vehicle that is not in use all the time, consider renting it out through peer-to-peer car sharing platforms like Turo or Getaround. Earn passive income from rental fees paid by users while your car is idle.

26. ATM Rentals: Purchase or lease ATM machines and place them in strategic locations such as convenience stores, gas stations, or malls. Earn passive income from transaction fees charged to ATM users without the need for active management.

27. Digital Billboard Advertising: Invest in digital billboard displays and lease advertising space to businesses looking to reach a wide audience. Earn passive income from advertising fees based on impressions or duration of display.

28. Equipment Leasing: Purchase or lease specialized equipment such as photography gear, audio/video equipment, or construction machinery, and lease it out to businesses or individuals. Earn passive income from equipment rental fees without the need for active maintenance.

29. Community Solar Projects: Invest in community solar projects or solar energy cooperatives that allow individuals to own or lease solar panels in shared solar installations. Earn passive income from solar energy production or renewable energy credits.

30. Livestreaming Revenue: Create and monetize live streaming content on platforms like Twitch, YouTube, or Facebook Live. Earn passive income from ad revenue, sponsorships, donations, or subscriptions to your channel.

31. Membership Subscription Boxes: Create and curate subscription boxes with niche products or services and offer them as a monthly subscription to customers. Earn passive income from subscription fees while providing value to subscribers.

32. Renting Outdoor Recreational Gear: If you live in an area with access to outdoor recreational activities, consider renting out gear such as kayaks, bikes, camping equipment, or snowboards. Earn passive income from gear rental fees during peak seasons.

33. Pet Rental Services: Offer pet rental services for special occasions such as weddings, photoshoots, or events. Rent out well-trained pets or animals for short-term use and earn passive income from rental fees.

34. Investing in Renewable Energy Projects: Invest in renewable energy projects such as wind farms, solar installations, or hydroelectric plants through crowdfunding platforms or investment funds. Earn passive income from dividends or returns on investment in clean energy.

35. Remote Work Consulting: Offer consulting services to businesses transitioning to remote work environments. Provide expertise and guidance on remote work policies, technology solutions, and productivity strategies to earn passive income from consulting fees.

36. Investing in Farmland or Timberland: Purchase farmland or timberland and lease it to farmers or timber companies for cultivation or harvesting. Earn passive income from lease payments or crop/timber sales without the need for active involvement in farming or forestry.

37. Event Space Rentals: If you own a property with ample indoor or outdoor space, consider renting it out for events such as weddings, parties, or corporate gatherings. Earn passive income from venue rental fees without the need for active management.

Wrapping Up The Best Ways to Make $1,000/Month Passive Income

So, you want to make an extra $1,000 per month. That’s doable. You just have to decide on a strategy and stick to it. I’ve made thousands of dollars per month with most of the methods I covered today. Here’s a recap:

- Dividend-paying stocks. Think Enbridge, Coca-Cola, Exon, etc.

- Invest in real estate or real estate investment trusts (REITs).

- Publish e-books on platforms like Amazon KDP.

- Teach online courses through websites like Teachable.

- Do affiliate marketing and blogging.

- Create a print-on-demand business.

- Start an online store using Shopify.

- Develop mobile apps.

You can learn more about making money and related topics in my online courses.