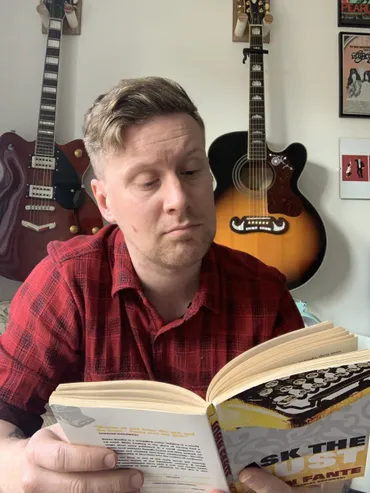

You’d be crazy not to use content marketing in 2019.

Heck, look how much it’s grown in popularity since 2004:

More and more businesses are producing content to acquire customers organically, build trust, and become a thought leader.

Yet so many companies are still stuck in the stone age when it comes to marketing.

Sure, commercials and print ads work, but they’re declining at the speed of light.

What’s one industry that’s outdated in terms of marketing? Banking.

Despite having a positive outlook and consistent growth, many financial institutions are late to the party when it comes to marketing.

That’s why I’ve put together this guide to teach banks and similar institutions how to execute content marketing properly.

It will help you generate more customers and jump ahead of other banks.

Keep reading if you want results like that.

What is content marketing for banks?

Content marketing is the process of producing articles, videos, and other useful forms of content to grow a business.

Practical and high-quality content enhances trust with customers, increases website traffic, generate leads, and has many other benefits.

Tell me one household name brand that doesn’t produce some form of content on a regular basis for their customers.

There isn’t one!

It’s the norm now for businesses to publish content whether it’s on a blog, YouTube channel, or through an email newsletter. More on that later, though.

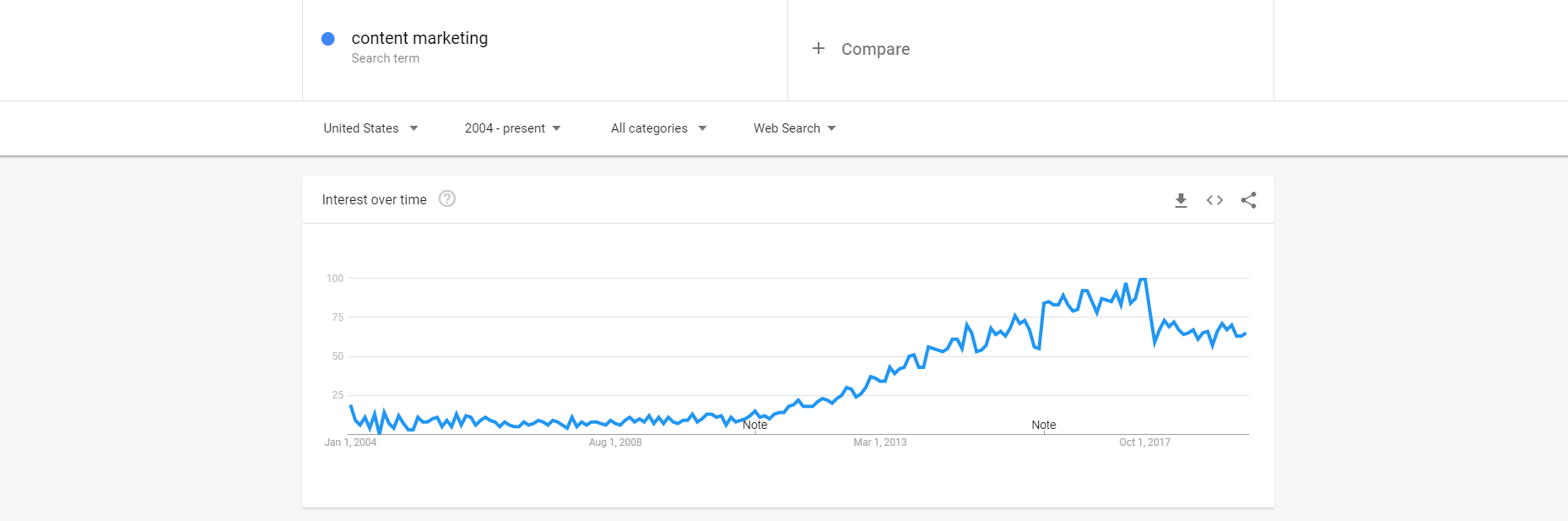

Content can also be aligned with the different stages of the buyers journey.

The reality is that no customer is the same. They all have unique wants, needs, and fall into different categories.

Take a look at this graphic detailing the three stages of the buyers journey:

The first is awareness. Here customers are just becoming aware that they need a problem solved. Since we’re on the topic of banking, perhaps its related to saving, investing, or getting a mortgage.

The second stage is consideration in which customers perform their research to understand what options they have to choose from.

Finally, customers enter the decision stage where they make a final choice on what bank to do business with. You want to be the one they choose and content marketing will achieve that.

Look at the buyer’s journey as a funnel similar to when you’re pouring fluid into a bottle.

The top of the funnel is wide and will easily capture a large number of users. Blog posts, videos, and social media posts are great for this.

The middle of the funnel is tighter and gets higher quality prospects. Whitepapers and case studies are commonly used to attract middle of the funnel users.

The highest quality leads will come from the bottom of the funnel content. Free consultations, demos, and similar offers will attract the most serious of people who are likely to convert into a paying customer.

But enough with boring mumbo jumbo. Let’s dive into what you here for…

How can banks use content marketing?

The following are effective content marketing strategies banks can use to begin attracting more leads to their institution organically.

Produce articles that answer questions customers have

One of the simplest and most efficient ways to begin content marketing as a bank is through the use of a blog.

Blog posts only require a CMS(content management system) which you may already have, but if not, it’s easy for an experienced developer to create and implement onto your website.

Blogging also needs less time, software, and employees compared to producing length videos or podcasts.

TD Newsroom is a great example of this.

They publish regular articles on topics that matter to their customers which brings relevant users to their website and educates existing one.

There are a few elements you must nail to succeed in blogging, though. They include:

- Word count: Gone are the days of 500 word blog posts. Long form content is proven to rank higher in Google and offers more value to readers. Don’t write any less than 1,000 words and don’t be intimidated to spend time writing thousands.

- On-page SEO: Ensure that your content writers are educated about title tags, meta descriptions, keyword research, and other SEO strategies. Applying these to each blog post will ensure that you increase organic traffic from search engines as much as humanly possible.

- Practicality: Most blog posts will be informational in nature which means users want to LEARN something. Guide them step-by-step through topics, cite studies, offer tools for them to use, and make each post as actionable as possible.

- Promotion: Never publish an article and twiddle your thumbs. Promote it on social media, email newsletters, and by sharing it with influencers.

- Repurpose: Take your blog post and use it as the basis for a video, infographic, podcast episode, and other forms of content. This effectively allows your bank to produce one piece of content and quickly turn it into several.

Create an FAQ page

Some users have a simple question that doesn’t require a 2,000 word article to answer.

Some times the answer is as simple as a single sentence. That’s where FAQ pages come in very handy.

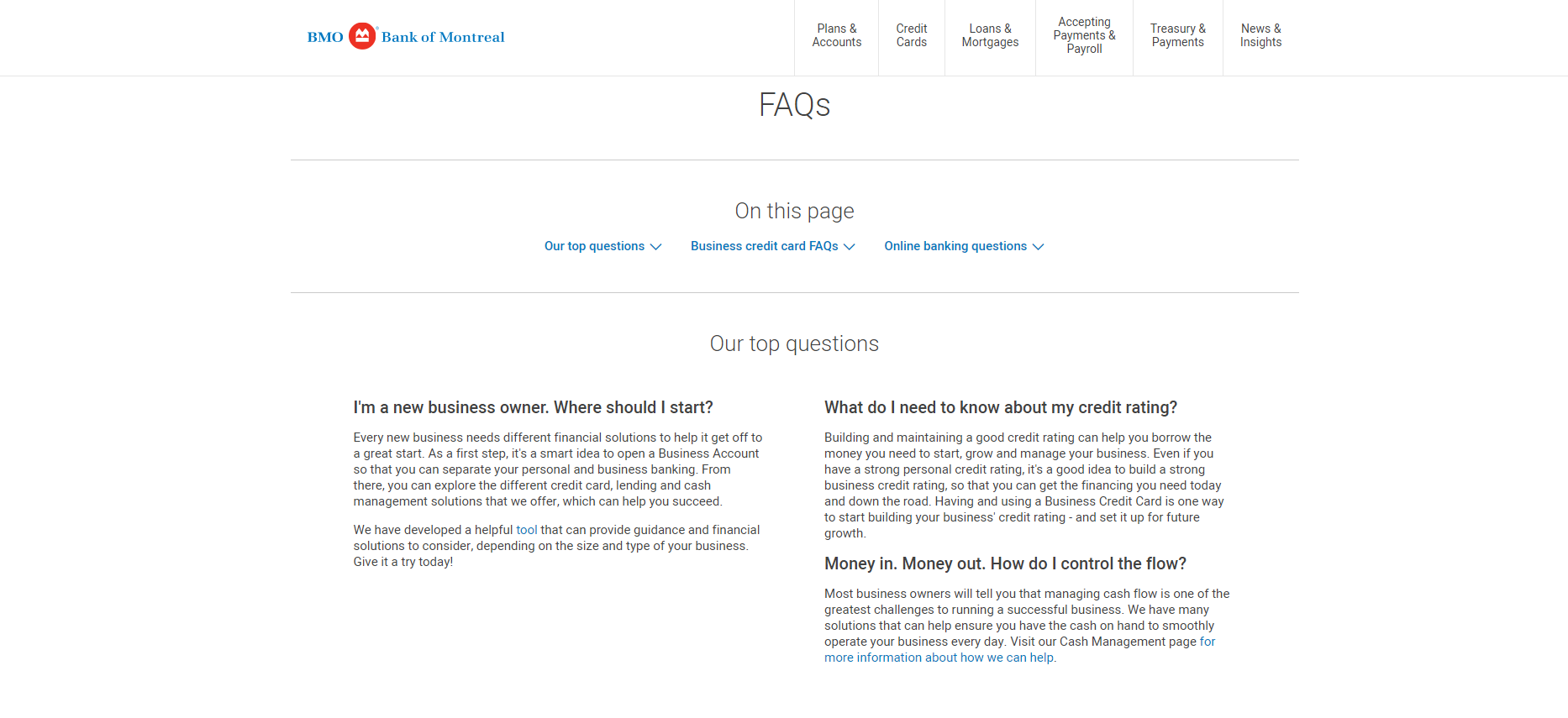

Look how Bank of Montreal uses an FAQ page to help business banking customers use their service more easily:

Questions cover everything from business credit cards to credit rating and foreign exchange.

This saves the user heaps of time because they don’t have to contact customer service or read long pieces of content.

You can also link to pieces of content from an FAQ page to drive traffic to your blog or another channel.

Begin by answering any questions you believe users would need to learn about. These include signing up, fees, navigating products like online banking, etc.

Once you have a solid foundation of information on your FAQ page, pay close attention to customer service data.

You may find that customers are asking or commenting on certain features that can be implemented into the FAQ.

Furthermore, banks can send out email surveys through free tools like Google Forms to ask what information they’d like to see be added to the FAQ for direct feedback.

Create mortgage calculators and similar tools

Anybody can publish a few blog posts and call it a day. But few companies take it to the next level by developing tools to help users.

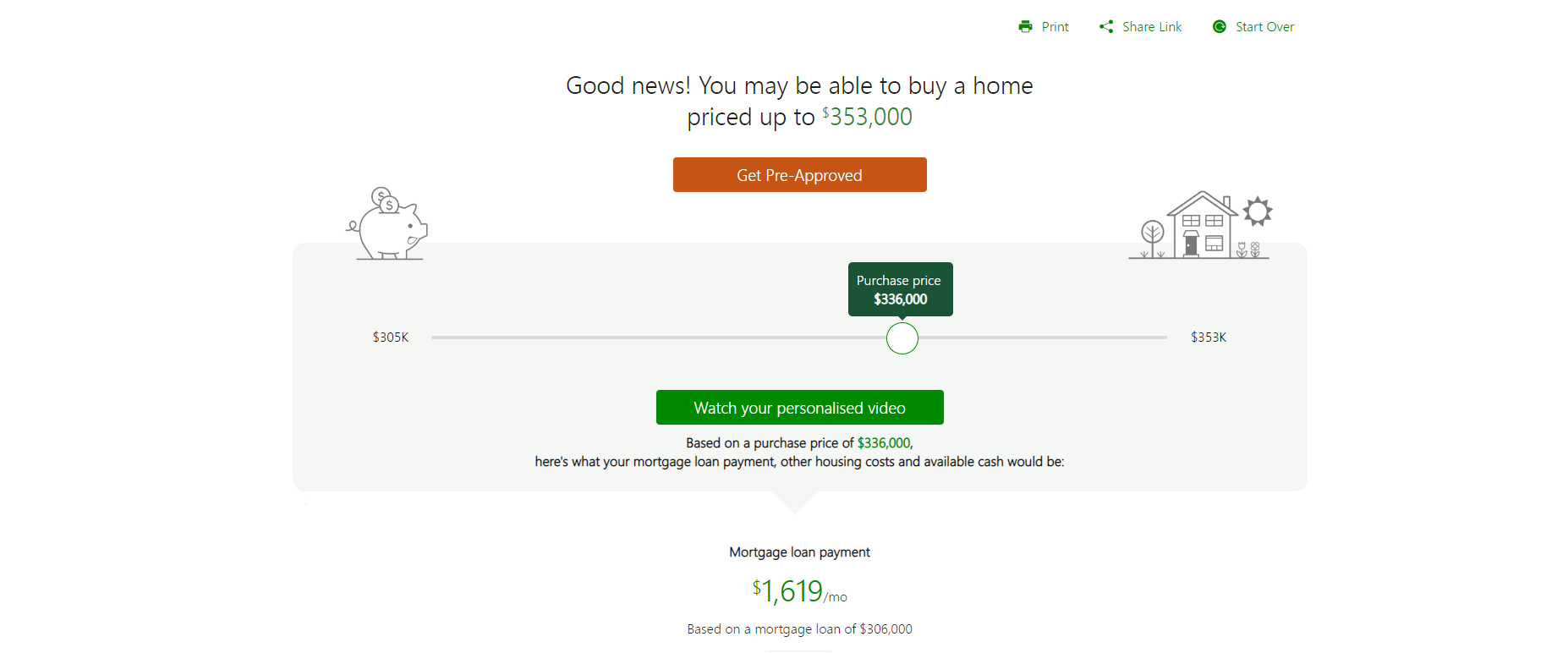

Let’s use TD as an example again. They have a variety of calculators available online including their mortgage affordability calculator.

Users enter their income, location, and monthly expenses to determine how much mortgage they could be eligible for.

There are several calls to action below this for users to book an appointment for beginning their homeownership journey.

This is an excellent example of a lead generation funnel.

People using this calculator are interested in getting a mortgage and owning a home.

Placing calls to action prompting them to schedule a meeting once they know much they can afford gets them closer towards the sale.

Educate customers through podcasting

Did you know that 70% of American’s are familiar with the term podcasting?

It’s quickly become one of the most desired and consumed forms of content.

Think about it.

You can listen to a podcast while you’re working, eating, studying, driving, or doing anything else.

It’s simply convenient. Articles, books, and videos need your full attention versus a podcast that can run in the background while you do other tasks.

This is also why institutions like the European Investment Bank produce podcasts on relevant financial topics.

The best part about producing podcasts is you need very little equipment to begin. A mic and recording software are the only things required to get started.

The key is to touch on topics that your customers care about. Think saving, investing, mortgages, building credit, and related subjects.

Offer them practical and actionable advice they can apply right away.

They will be more willing to share this kind of content as it’s genuinely helpful.

Improving their lives will also make a long lasting impact and could very well increase their lifetime value and willingness to become a customer if they aren’t already.

Podcasts can be uploaded to your bank’s website along with:

- Soundcloud

- YouTube

- Blubrry

- Libsyn

- PodBean

- PodOmatic

Offer whitepapers to persuade readers

Does your bank publish whitepapers? It should.

Whitepapers are academic reports that cover a very specific topic with the goal of persuading readers.

Banks can use whitepapers to educate individuals on investing, homeownership, and similar concepts.

Just like other forms of content marketing, this builds trust with readers and helps you position your products as solutions.

Bank of Canada is a great example of this. They publish white papers on a variety of topics like technology and macroeconomics.

Make sure to read my guide on writing whitepapers, as well. I teach you how to easily create, publish, and distribute whitepapers in that article.

Take advantage of testimonials and turn them into content

Reviews and testimonials are perhaps the most effective forms of content you can produce.

They are literally a current or previous customer speaking about their positive experience with your bank.

In fact, 38% of consumers say that reading online reviews before making a purchase is “very important”.

It makes sense, too.

Testimonials act as social proof and give you insight into whether or not a company is trustworthy. Seeing another person, who is just like you, leave a good review will make you more likely to become a customer.

That’s why your institution needs to leverage customer testimonials as content. These can be posted on social media and any other channels you’re active on.

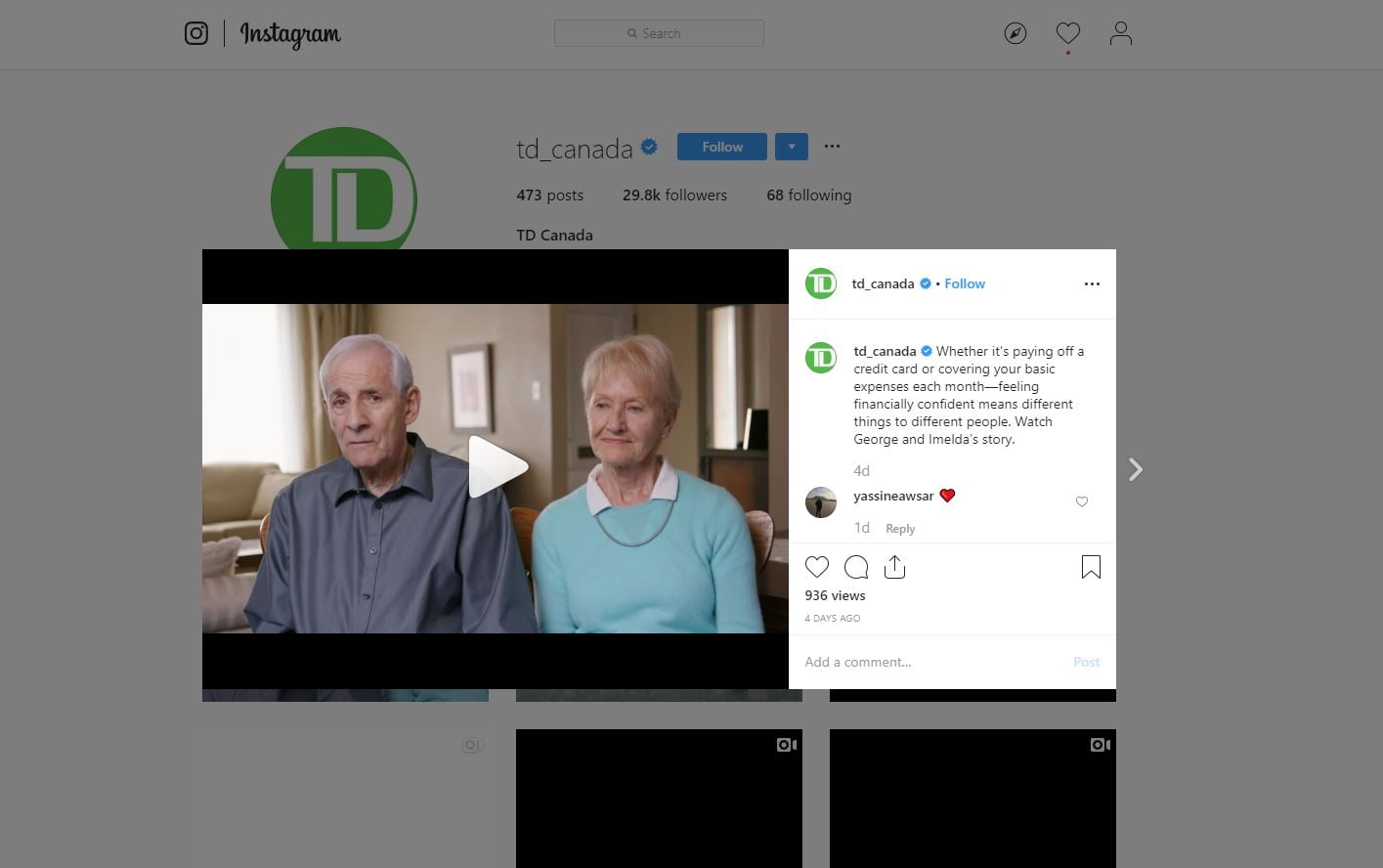

Look how TD used a customer’s story about building credit on their Instagram account:

This simple video is very relatable to their followers and proves the quality of TD’s services.

Final thoughts on content marketing for banks

Banks and other financial institutions can use content marketing for educating customers, attracting new clients, and building authority over competitors.

The first step is to determine what type of content you’d like to focus on first. This is usually blog posts, videos, or podcast episodes.

Spend time promoting each content you publish across social media networks, content syndication sites, and via email newsletters.

Content should be based on topics that existing and potential customers would be interested in. This educates them about the importance of a subject, and your services can be tied in as the solution.

Offering an FAQ page is a nice static resource to help customers, and you can continually add to it as you collect feedback.

Finally, consider hiring a developer to create tools like mortgage and investment calculators. These work perfectly when integrated with lead generation funnels.