Both non-profit and for-profit businesses can apply for grants that will help get their feet off of the ground.

Having up-front capital allows you to jumpstart your organization, potentially saving years of generating that money yourself.

This is why it’s critical that you understand the fundamentals of grant writing, so you can maximize the odds of getting accepted.

There are over 1,100 grants available for non-profits in Canada, let alone in the United States and other countries.

That means it doesn’t matter where you live, learning how to write grants is universal and there are opportunities all around the globe.

Follow along as I teach you how to write a proposal to land the grant you’re after.

Step 1: Put together a grant cover letter

Look at a cover letter like a first impression. It will give lenders a preview into the proposal you’ve written and helps you to get them interested before they’ve read it.

Cover letters should be straight to the point while explaining why you deserve the funding and that you understand the lender.

Here are a few extra tips for writing good cover letters:

- Date and letterhead: Applicants should place the date that is on the grant application on the cover letter, as well. This makes all of the material and documents you deliver look consistent.

- Address and personal information: The inside address should include the organization’s person of contact’s name and title. Follow this with their name, address, city, state/province, zip code, etc.

- Address the right individual: You don’t want a grant proposal to be vague or generic. It needs to be targeted. Always use a personal title and last name like “Dear Mr. Brown” when addressing the lender, as it shows you’ve done your research and makes it more personal.

- Write a quick intro: The introduction of the cover letter needs to be like an elevator pitch. Explain your organization, what it does, and why you require funding. It’s also effective if you can cite data that backs up why your organization is important in current market conditions.

- Summarize and close: Remember, cover letters are short. Write up to a couple of paragraphs explaining how your organization would benefit from funding, why it suits the lender’s portfolio, and close the letter with a quick summary.

Formatting the grant in this way helps give lenders all of the information they need to make a decision while increasing your chances of getting accepted.

Additionally, here’s a cover letter template you can use yourself. Simply fill in the sections with your information and edit it according to your business.

Grant proposal cover letter template

John Smith (Person of contact in the lender’s organization)

Account Executive (Person of contact’s position)

Young Entrepreneur Society (Lender’s organization name)

1787 Westlane st. (Funder’s street address)

Toronto, ON M4B 1B3 (Funder’s city, state/province and zip code)

Dear Mr. Smith:

The digital marketing agency New Digital (Your company) requests a grant of $100,000 for our new Help Small Businesses project.

Despite the city of Toronto having a population of 3 million, and Canada having over 1.17 small businesses, many of them do not have an internet presence in our digital world. This is why we are starting the Help Small Businesses project to provide affordable digital marketing services to small businesses, so they do not have to sustain unaffordable costs from larger agencies.

New Digital consists of young and enthusiastic board directors that have all graduated from University of Toronto, and have competed in several entrepreneurial competitions. We all have also founded multiple businesses in the past, giving us the experience to use funding wisely to achieve our goals and keep Young Entrepreneur Society’s brand in line.

Throughout the execution of our new project, we will be providing local businesses with websites, social media marketing, email marketing, and search engine optimization services. We will also consult them on how to use these platforms and strategies effectively, so they are knowledgeable to manage them alone.

Thank you for taking the time to read our cover letter and proposal. Please feel free to contact Matthew Marcus, Head of Communications, with any questions you might have about our organization, proposal, or project at 289 502 6199 or matthewm@newdigital.com.

Sincerely,

Todd River

Director

Step 2: Write the executive summary

The executive summary prefaces the rest of your proposal, describing the details of your organization, goals, strategies, and desired outcomes. Financials, charts, and other in-depth data are better saved for later on in the proposal.

You want an executive summary to grab the attention of the lender, while explaining exactly what you do, trying to achieve, and why they should consider funding your organization.

Think of the executive summary similar to the cover letter, but more in-depth. It needs to read like an elevator pitch, quickly summing up the value proposition of your business and its most important aspects.

Check out this simple elevator pitch template. Answer the questions it contains, and it will help you write a good executive summary.

This also acts as a great opportunity to drill deep into what makes your non-profit or for-profit different from others in the market. You will see what’s important and what can be left out. It’s often said that writing the executive summary is the most important section of any proposal.

While there is no cookie-cutter way to write an executive summary, these are some best practices I suggest that you follow:

- Strengths: Outline the strengths of your business, and what separates you from the rest. A lender wants to invest in an organization that can disrupt the market and does something new.

- Audience: Display that you have clear buyer personas by detailing the demographics and other information of your ideal customer.

- Outcome: What do you want to do with the funding? What does the end goal of your organization look like? Paint a picture for the lender.

- Results: What existing results do you have to show? This can include revenue, customers, website traffic, social media engagement, or any other important metrics that are important for your individual business and industry.

- Patents: Explain any patents that you currently have or are trying to obtain.

- Problem: What’s the problem you are trying to solve? Every business is solving a problem for customers, so make sure to explain what you’re trying to help in the community.

- Solution: After identifying the problem, show the lender that you’ve planned out a solution and steps for executing it.

Make sure to read my guide on financial copywriting for more ideas like these, too.

Step 3: Make a statement of need

The meat and potatoes of a grant proposal is the statement of need.

It is the section that explains why your organization or project is necessary, and why funding is needed. This also shows lenders that you are capable of thoroughly explaining a business and its purpose.

Research the market you’re entering deeply to determine if there’s truly a gap to fill. You should understand your target audience, opportunities, and threats in-depth. All of this needs to be explained in the need statement to sway lenders.

I recommend using data and real statistics to back up the need.

For example, if you are trying to build a non-profit to help elderly individuals, cite numbers that talk about the rising elderly population and the city’s declining healthcare budget.

Making claims without real data to back them up will have you looking like an amateur in the eyes of a lender. It goes without saying that it will hurt your chances of receiving a grant, as well.

It’s a simple mistake you can avoid, so reference as many resources as possible throughout the grant proposal.

Step 4: State your goals and objectives

An organization needs clear goals and objectives. Otherwise, you will be growing the company aimlessly. Lenders want to see that applicants have a clearly outlined future for the business, which ultimately means their investment will be used wisely.

Ensure that you cover both goals and objectives. Goals are the overarching milestones you wish to reach, such as a certain revenue level or market share. Objectives are the individual steps it will take to get there.

Your proposal needs to have all of the basics cover, such as:

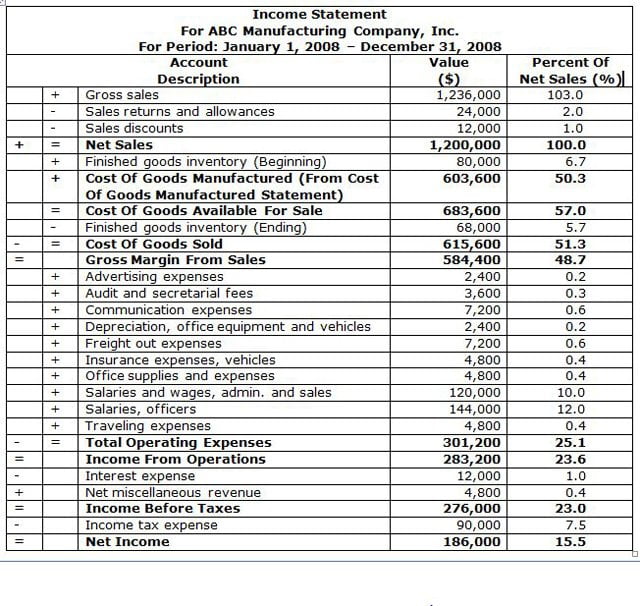

- Profit and revenue: What kind of profit goals does your organization have? Be realistic, and be prepared to have forecasted income statements and balance sheets prepared. Use available market or annual reports from other companies to get comparable data to base yours off of.

- Work goals: These are goals that pertain to productivity, equipment, employees, and networking.

- Problem solving: What issues do you see that will arise in both the organization and market? Show lenders that you can look into the future and plan ahead by setting goals and performing risk management.

- Innovation: Include goals about what you’d like to change in the industry you’re entering. Lenders like investing into companies that can disrupt the norm and do something special.

Since writing isn’t everybody’s strong point like me, I suggest that you read my blog post on the best writing process steps to speed up your workflow while reducing stress.

Step 5: Outline your strategies

The strategies section of a grant proposal covers the exact techniques your organization plans to deploy to reach its goal. This area of the proposal can take the objectives you touched on in the goals section, and elaborate on how they will be achieved exactly.

Strategies should include marketing, handling finances, dealing with competition, and anything else you find necessary in your specific industry.

Step 6: Explain how you will measure success

Strategies, finances, and other components of a successful company need to be measured. This ensures that a business is progressing in the right direction, and achieving milestones.

Lenders are interested in seeing that an applicant has a system to determine if their strategies are working. This may include key performance indicators, meetings, and tools you will use to track progress.

If you’re learning how to write a business grant proposal, do not skip over this section.

Think about it from the lender’s perspective…

They’re giving you a lot of money and want to ensure that it’s used well.

If the recipient, you, doesn’t have a clear plan of action to measure success over the long term, it will be a very disorganized business. A.K.A the lender’s money may be wasted.

Create a clear vision of how you will ensure goals and milestones are met to make lenders more comfortable.

This brings me to my next point.

Step 7: Offer detailed a budget and finances

Perhaps one of the most important elements that a lender is looking for in a grant proposal is the finances. They want to see how and where their investment will be allocated.

If you don’t have a thorough financial section, how will they know their money will be spent wisely to grow your company?

This is why applicants need to create a forecasted income statement and balance sheet. Here’s an example of what an income statement looks like.

Step 8: Provide any additional documents

Finally, it is recommended that you attach the following documents to a grant proposal:

- A tax-exempt form if you are a non-profit.

- A list of the board of directors, contact information, etc.

- A budget for the current and next fiscal year.

Lenders may ask for additional material, so make sure that it is all neatly organized before you send it in. Presentation and the ability to clearly propose your idea will help lenders look at you more favorably.

Final thoughts on how to write grant letters

Learning how to write a grant proposal is both exciting and nerve-racking. There’s lots on the line, and you could potentially be skyrocketing your organization.

It all begins with crafting a good cover letter. Address it to the exact individual that will be reading the proposal, and don’t go overboard. The cover letter is a brief introduction to your idea, who you are, and gives lenders an idea of what to expect before continuing.

You then need to write a great executive summary. This elaborates on the overarching mission and vision of your company. Include information about the target market, audience, goals, opportunities, and threats to display you’ve thoroughly researched the industry.

This will naturally lead to the state of need where you cover why funding is required for your organization and why it will be a good investment for both parties.

Clearly outline the goals, objectives, and strategies of the business after this. Have goals that cover a wide spectrum of areas, such as finances, innovation, and workflow.

Grant proposals also require a section that explains how progress and performance will be measured. Here would mention systems or software that will be used, along with KPIs.

Finally, flesh out a section that forecasts the financials of the organization. Dive deep into expenses, liabilities, profit, and don’t skimp out on detail.

Attach any other required documents to the proposal, and you can look forward to receiving funding 🙂

If you need a copywriter to help you write grants, reach out to me at any time and I’ll help you get the funding you deserve.