Are you starting a freelance writing business?

It’s exciting and nerve-racking at the same time.

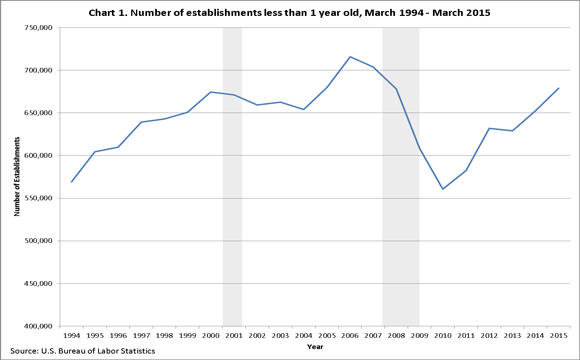

According to the Bureau of Labor Statistics, there are constantly new businesses arising in the United States.

Choosing the right structure to register as is an important first step these businesses will take including yourself. There are a lot of choices which can make it confusing though.

Sole proprietorship and an LLC are two options that business owners commonly use. Don’t worry if these names sound confusing, all of that mystery will be solved ahead.

Let’s look at exactly what these business structures are for freelance writers and how they differ in costs, taxes, and liability.

What is a Sole Proprietorship?

The most common business structure.

A sole proprietorship is a business owned and operated by a single person. Married couples can also be placed under a single sole proprietorship.

It is the simplest and quickest business to form, thus why it’s so widely used. According to LegalZoom, there are approximately 23 million sole proprietors in the United States.

This is a great place to start when choosing a freelance writing business structure.

It’s simple, low cost, and you can register very quickly.

That brings me to my next point.

Benefits of a Sole Proprietorship

For as little as $60, you can register your freelance writing business as a sole proprietorship (this will depend on where you live).

The affordability is one of its main benefits. Very little paperwork is also required which quickens the process and lowers the barrier to entry.

Do you dread complicated processes? If so, you’ll appreciate being a sole proprietor.

This business structure also gives you full control of your business. Any and all business decisions are in your hands. When choosing a name, you are given lots of freedom as long as it isn’t already taken.

Finally, taxes. No one looks forward to them. Unless you’re an accountant!

But, as a sole proprietor you don’t need to file taxes separately. Your earnings are counted as personal income which makes tax season a heck of a lot simpler.

When your business grows and it may be better to switch structure, you can easily do so. Businesses that begin as an LLC or corporation for example, experience more difficulty dissolving back to sole proprietor status.

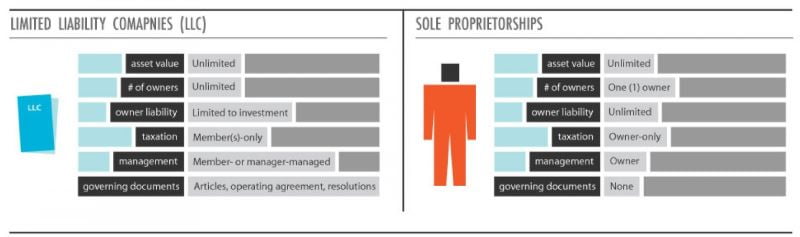

Check out this neat infographic on the pros and cons of these two business structures from Cooklaw.

Disadvantages of Being a Sole Proprietor

Unlimited personal liability is perhaps the greatest disadvantage. Legally, there is no distinction between you and your business.

Any debt and liabilities that you accrue will be your complete responsibility. If you can not cover the costs, personal assets may be used including bank accounts and property.

Sole proprietors also can not issue stocks. This makes it much more difficult to attract investors.

However, most writers aren’t going to seek investments unless they plan to expand into SaaS, consulting, etc.

If you’re interested in raising funding for your business, the most likely option will be to borrow. Taking out loans in this position may force you to put up personal assets as collateral.

Is Sole Proprietorship a Corporation?

No, a sole proprietor is not the same as a corporation. In fact, it is the complete opposite.

A corporation is completely separate from you, the business owner. If someone were to sue you (knock on wood) they could sue the company, but not you personally.

It’s not the silver bullet everyone claims it to be though.

Don’t expect to pull off Wolf of Wall Street shenanigans and expect an LLC to cover you. 😂

Is Sole Proprietorship Worth it?

Many tax consultants and business owners will tell you one thing in common — it’s not necessary to incorporate until you are netting six figures. This is for a few different reasons.

Firstly, the tax differences are not going to make a huge impact until you’re earning a substantial amount of money. Incorporation has high fees, some of which are annual, and you’ll most likely need to get a lawyer and accountant involved.

Because of this, the costs can be much higher. Sole proprietorship is perfect for those just getting started, earning a modest living, or writers that want to keep things simple.

There are business owners who earn very high six figures who still remain as a sole proprietor. There’s no rush and it’s definitely worth it especially in the beginning.

What is an LLC?

LLC is an abbreviation for “limited liability company”. It is a structure that prevents members from being held liable for debts or liabilities, hence the name.

This model combines the benefits of a corporation and sole proprietor into one.

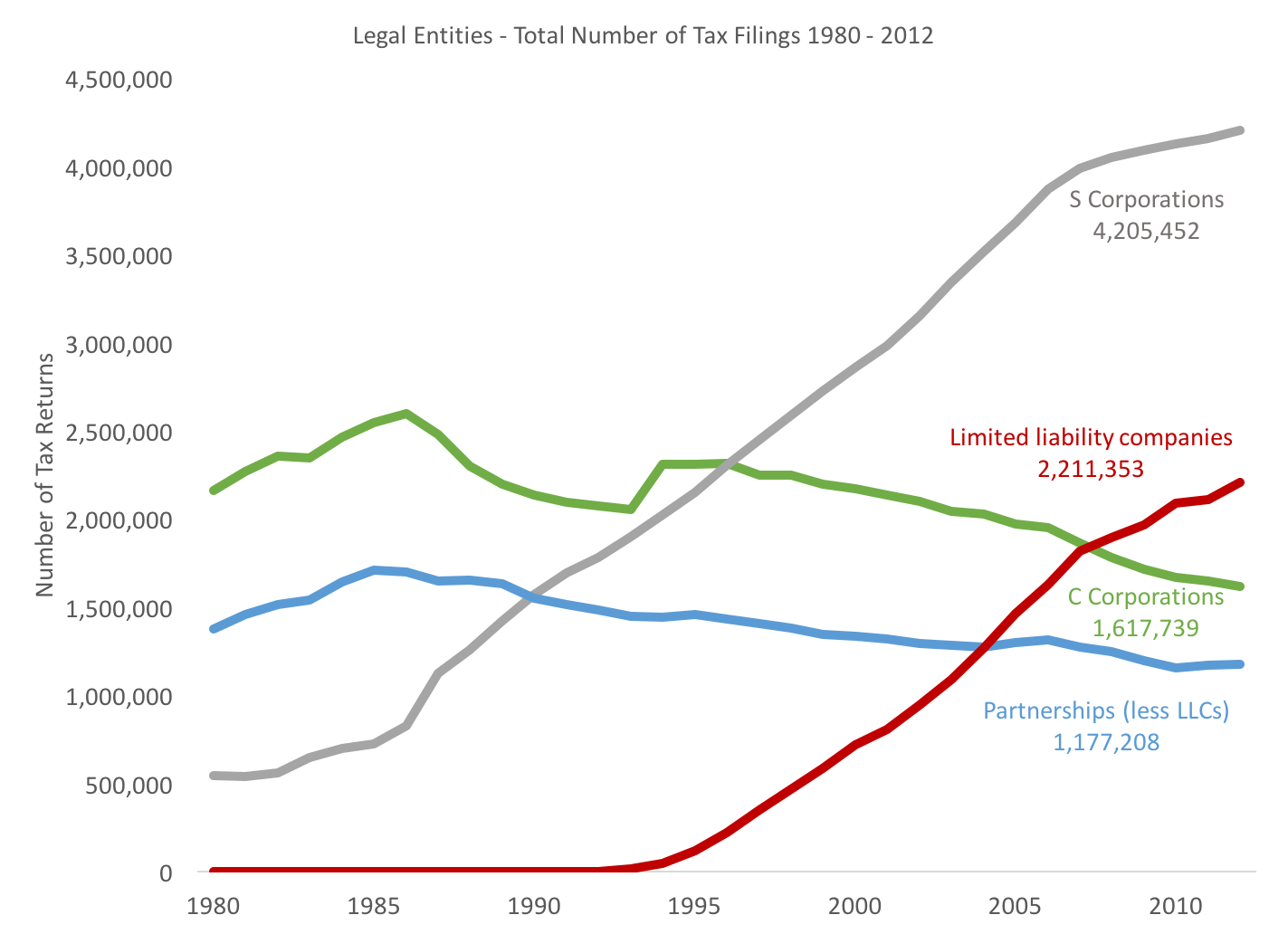

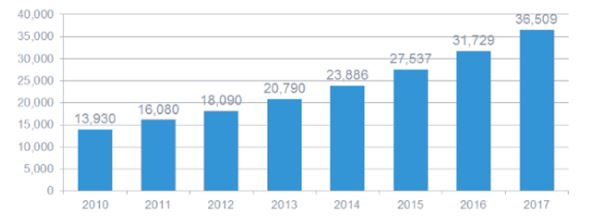

Over the past three to four decades, LLCs have gradually outgrown the amount of sole proprietors and C corporations.

Benefits of an LLC

Similar to being a sole proprietor, you avoid double taxation when you’re registered as an LLC.

As the owner, you report profits and losses on your regular tax return. You will also have the freedom to choose how you want to be taxed.

If the business involves partners, you can elect to be taxed as a traditional partnership. The members of the LLC can also file as a corporation if they wish. Overall you are given plenty of tax flexibility.

The biggest benefit of choosing an LLC as a freelance writing business structure is the legal protection. As a sole proprietor, if you acquire debt or liabilities, your personal assets can be seized.

As an LLC, you are not held liable but rather the company is. You and your business are completely different entities.

Having an LLC in place can also add to your brand image or as a business partner. It has a much more trusted reputation in the business community.

Disadvantages of LLC

Want to issue shares of stock? Well, unfortunately as an LLC you won’t be able to. This can limit your growth as it isn’t as attractive to investors.

Most states also treat LLCs different in terms of what is required and the paperwork that must be done. You will have to do extra research to assure you register correctly.

The benefit of limited liability may come at an extra cost known as a franchise or capital values tax. Jurisdictions including California, Texas, New York and more have this in place currently.

You will typically be paying several hundreds of dollars to file as a limited liability company. There are also annual fees to renew your registration. For businesses that are bootstrapping, this can be a minor setback.

Is an LLC Worth it?

LLC’s are completely worth it if you value security, are earning approximately six figures, and are willing to spend the extra money to incorporate.

You will be protected in the case that your business gets sued or goes under. You will save on taxes and other businesses tend to look at LLC’s more highly than solo entrepreneurs.

But, you also have to be willing to put more work in. You’ll be filing more documents and the overall process is a bit more complicated. You will still have to file personal income on top of doing your corporate taxes.

Operating agreement

If your freelance writing business involves partners, you will need to write an operating agreement. While not legally required, it can solve a lot of headaches later. This can be a complicated process which may require a professional to help you.

The agreement usually spells out the rights and responsibilities of the owners. In case of the company dissolving or issues, you’ll be happy you did this step.

Members of an LLC may be subject to self employment taxes, as well. In that case, profits aren’t taxed at a corporate level. Members will have to report profits on their federal tax return.

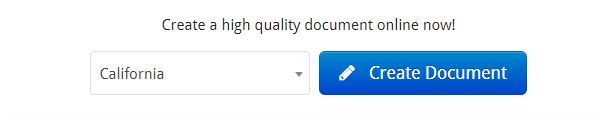

I’d recommend for this step that you use the free website eForms. They will generate you a free operating agreement, saving plenty of time and energy.

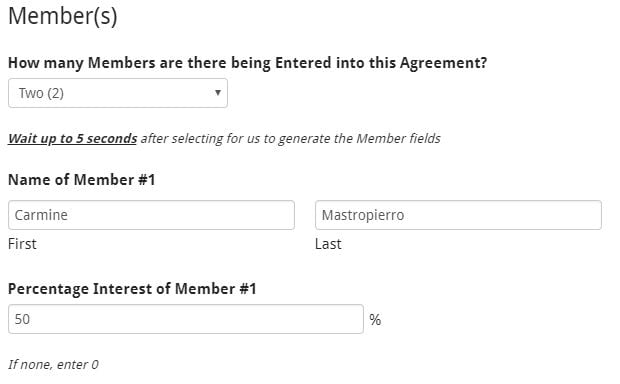

Begin by selecting your state from the drop-down menu and selecting the “Create Document button.”

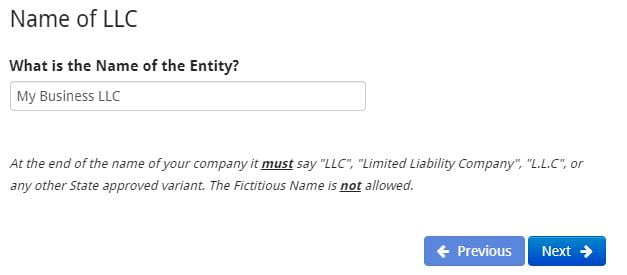

Next, you’ll be prompted to enter a name for your business. It needs to end with “LLC” or a variation of it.

Hit “Next” and you will need to select your state again to choose which laws the LLC will be under. After this, you get to the choose the exact date it becomes effective.

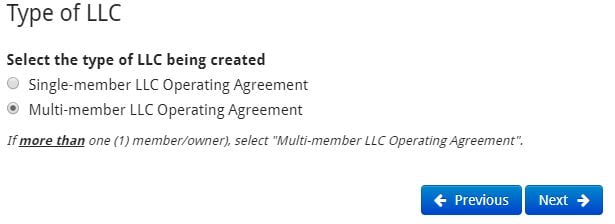

Then, assuming you have a partner, you will want to choose the multi-member LLC option.

You get the option to choose upwards to 20 members. But, for my example, I’ll just choose two since it’s a bit more realistic.

You will be prompted to enter the member’s name, ownership, and address.

There are many other required steps which aren’t difficult to figure out past this. They involve taxes, profit distribution, and other important areas.

After you are finished, it will ask for signatures to be official. I’d highly recommend creating this agreement if you plan to have partners.

Related reading: How to Write a Freelance Writing Contract + Template

How do I choose between the two?

Phew, that’s all over with.

Now you’re probably thinking, “How do I know which is right for me?”. Great question. It depends on a few different factors.

Sole proprietorship is best for entrepreneurs that:

- Plan to own a business by themselves.

- Are just beginning and want to keep things simple.

- Are comfortable with more liability as a business owner.

- Want to keep costs low at first.

Operating as an LLC would be more fit for business owners that:

- Want more legal protection and less liability.

- Wish to have partners in the company.

- Are fine with more paperwork and costs.

Costs of starting a freelance writing business

Both sole proprietorship and an LLC have their initial fees but what about other costs? These are some expenses that you should also consider when making a decision.

Hardware and software

Do you need a new laptop? a new phone? accounting software? To operate your business effectively, you’ll need tools to help out out.

Let’s take customer relationship management software for example. The industry itself is already exceeding $40 billion.

Businesses use CRM tools to automate sales, marketing, and customer acquisition. It can help you get more freelance writing clients, generate higher levels of revenue, and give you peace of mind.

Take Monroe Systems for example. By using a CRM, their sales reps were able to generate up to $50 more sales.

This kind of software can run you hundreds of dollars per month though. That’s why it’s wise to consider these expenses ahead of time so you aren’t blindsided.

I remember when I first started getting into business, I needed to buy a new computer, SEO software, and certain web apps. I wish I would have planned a bit better to see these costs coming, looking back.

Brainstorm a list of tools you need to keep your business running or that you believe you will need to upgrade. Write down an estimate of how much these items cost.

Working space

Are you working from home? A shared working space? This is another critical thing to consider.

One of the best perks of being a freelance writer is that you can work from practically anywhere.

Imagine kicking back at Starbucks, talking to clients, and handling emails. That could be you.

Of course, you aren’t going to be working at coffee shops 24/7. That’s why having a solid office at home or elsewhere is a great invest for your business.

A desk with plenty of space and a comfortable chair is essential. You’ll need room for your computer, documents, and don’t want back pain from sitting for long hours.

Also consider buying white boards, notepads, a stapler, and all of those little office items.

Marketing

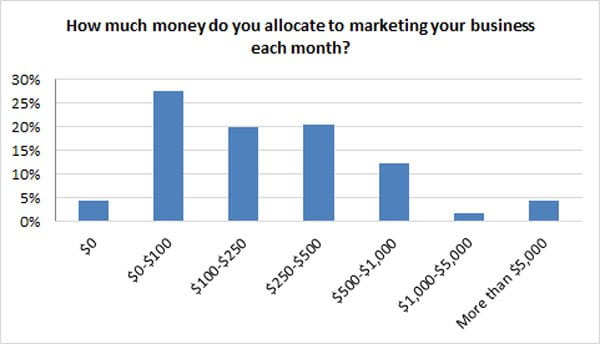

32% of SMBs only spend approximately $100 on marketing per month. Truthfully, you won’t get much results from that.

As they say, it takes money to make money.

If you are hiring consultants, marketers, or other experts, you can expect these costs to go up.

Also consider newspaper ads, business cards, and other forms of media you might invest into.

I suggest investing into yourself by purchasing courses, reading books, and getting a mentor.

Transportation

How will you be commuting as an entrepreneur? Do you own a car? Are you using the subway?

Going to networking events, meeting up with clients, and similar activities will be the norm for you. This will require you to have a reliable form of transportation.

Calculate the costs of gas, car repairs, public transit passes, or similar expenses you might have.

Banking

Do you want a line of credit? How about a business credit card? Well, that means you will need a business bank account.

Depending on the institution of course, the fees you pay will vary. I would definitely take this into consideration as a business account has many benefits. It also makes separating business and personal money easier.

Some banks will offer credit card processing if you run an online business, too. Typically this includes a one-time setup fee and a monthly payment.

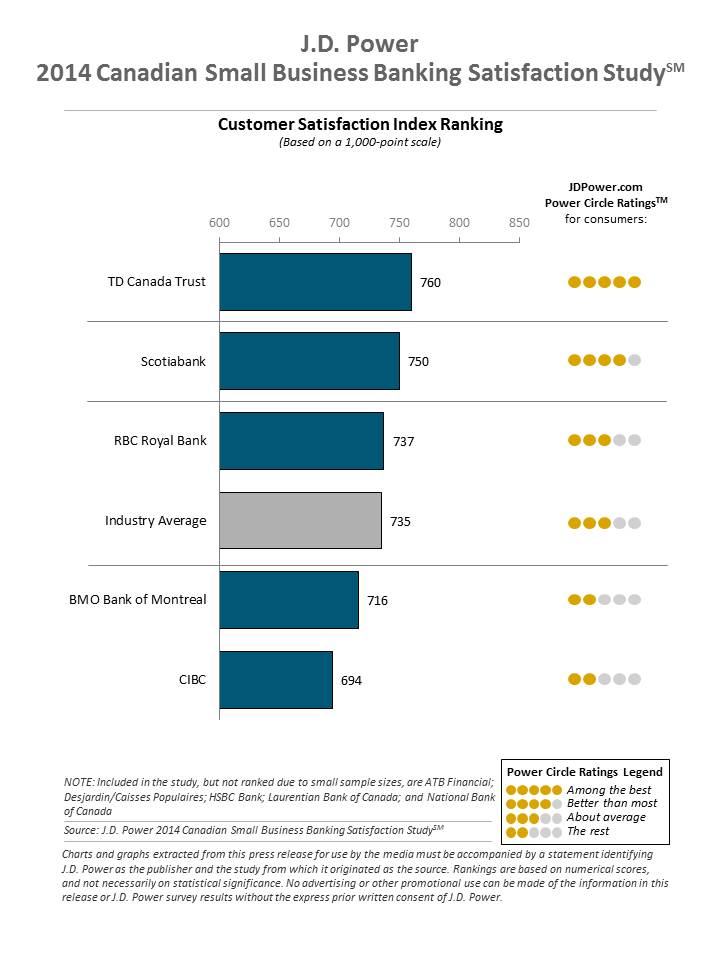

I’m Canadian, so for all my fellow canucks, take a look at this small business banking satisfaction index.

Related reading: 6 Financial Copywriting Tips You’d Be Crazy Not to Know

Wrapping up freelance writing business structure

When it comes to an LLC vs sole proprietorship, the deciding factors boil down to costs, if you plan to have partners, and how much risk you’re willing to take.

Remember that if you start as a sole proprietor, you can always upgrade to an LLC later. The opposite however is much more complicated.

No matter which choice you make, it’d be very beneficial to take the time to calculate expenses. You never know what software, equipment, or other things you might need that you didn’t think of before.

Please keep in mind this information is based on my experience as a copywriter and you should always consult with an accountant or lawyer to make the best possible decisions. 👌