Getting stiffed by a client is every freelancer’s worst nightmare. You did the work, met the deadlines, delivered results—and then nothing. Radio silence when it’s time for them to pay.

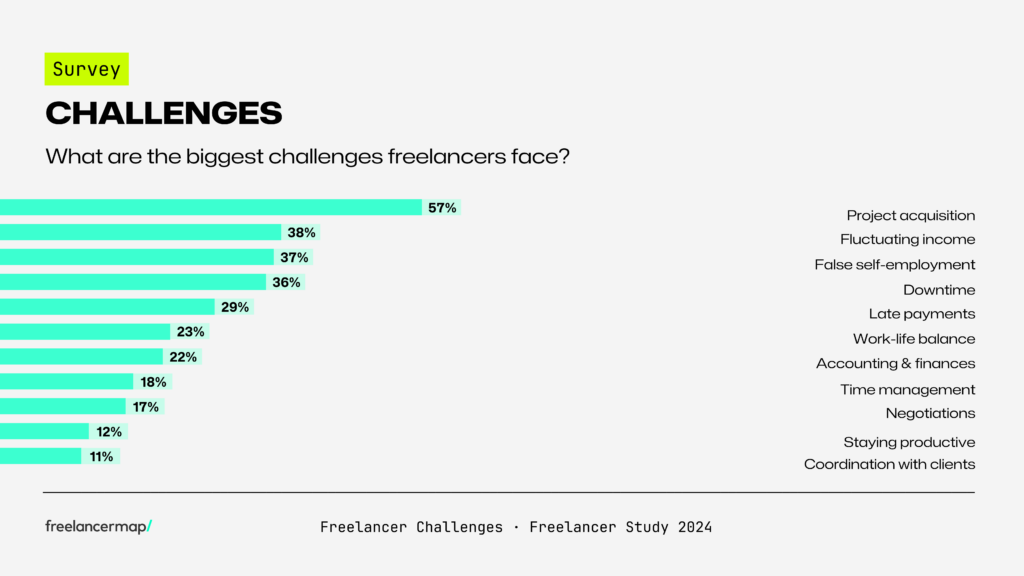

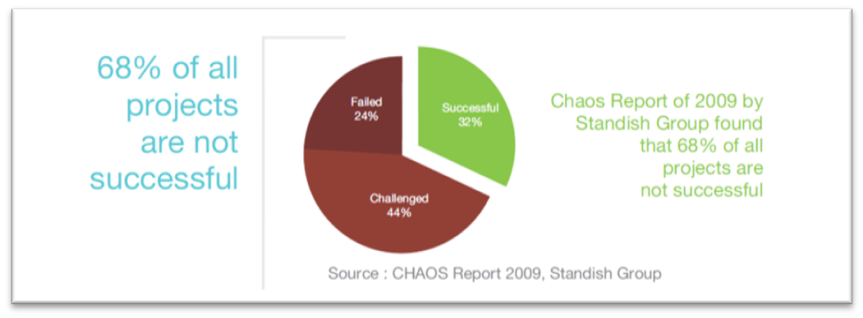

Unfortunately, this is more common than you think. In fact, 29% of freelancers experience issues with clients delaying or avoiding payments.

So, what do you do when a freelance client won’t pay?

Here’s the truth: you can’t sit back and hope they’ll come through. You need a plan—both for dealing with non-payment when it happens and for protecting yourself before it even becomes an issue.

This guide breaks down exactly what steps to take when a client refuses to pay, plus how to safeguard yourself in future projects so it doesn’t happen again.

Based on my 10+ years freelancing, here’s what you need to know.

Why Freelance Clients Don’t Pay

Before you jump to conclusions, let’s talk about why a freelance client won’t pay. Sometimes it’s not as malicious as it seems—though that doesn’t make it any less frustrating. There are a few common reasons clients drag their feet (or completely ghost) when it comes to payment.

1. Cash Flow Problems

Your client might be dealing with their own financial struggles. It’s not that they don’t want to pay you—they simply can’t right now. Maybe they’re waiting on their own invoices to be cleared, or they’ve mismanaged their budget. This is especially common with small businesses and startups.

2. Miscommunication

A surprising number of non-payment issues come down to misunderstandings. The client might claim the work didn’t meet their expectations, or they might argue that they didn’t know payment was due. Maybe you didn’t clearly communicate payment terms or deadlines upfront.

3. Disappearing Act

Then there are the clients who simply vanish. No emails, no phone calls, just radio silence. These are the most frustrating cases, and often the hardest to resolve. They’ve taken your work and ghosted, and you’re left wondering what the next move is.

4. No Contract in Place

No contract? Big mistake. Without a signed agreement outlining clear payment terms, deadlines, and consequences for late payments, you’ve left yourself open to clients who can dodge responsibility. That’s why a well-crafted freelance contract is non-negotiable in this business.

I always suggest my students find a free contract they can use like this one. Eventually, it’s wise to invest a few hundred dollars to have a lawyer draft one for you once you are generating income.

5. Dispute Over the Work

Sometimes, a client refuses to pay because they’re unhappy with the final product. This is where scope creep comes in—when a client expects more than what was originally agreed upon.

Or, they might claim that the work wasn’t what they expected, even if you’ve met all the terms. Without clear boundaries set early on, disputes like these can derail the entire payment process.

You might be surprised to hear that 68% of projects go unfinished. Scope creep contributes to this.

Understanding why a freelance client won’t pay is critical because it helps you figure out how to handle the situation strategically.

The next step? Fixing it—and ensuring you’re never in this position again.

Immediate Steps to Take When a Freelance Client Won’t Pay

So, the client isn’t paying. Don’t panic—there are steps you can take right away to increase your chances of getting paid without burning bridges. This isn’t the time to sit back and hope for the best. Be proactive, professional, and firm.

1. Send a Polite Reminder First

Before you go full-on collection mode, start with a friendly reminder. It’s possible your client simply forgot, or something slipped through the cracks. Send a short, polite email reminding them of the payment due date and attaching the original invoice.

Actionable Tip: Keep it professional but firm. Here’s a quick template:

Subject: Payment Reminder – [Project Name/Invoice Number]

Hi [Client’s Name],

I hope everything is going well. This is a quick reminder that the payment for [specific project] was due on [date]. Please let me know if there are any issues or if you need the invoice resent. Thank you for your prompt attention!

Best regards, [Your Name]

Sometimes, all it takes is a nudge to get things moving again.

2. Offer a Flexible Payment Plan

If the client responds and mentions cash flow issues, consider offering a payment plan. It’s better to recover something than nothing, especially if they genuinely want to pay but can’t afford the full amount upfront.

Actionable Tip: Propose breaking the payment into installments over a few weeks or months. Get it in writing and specify new due dates. This keeps things structured and formal, preventing further delays.

3. Send a Formal Demand Letter

When polite reminders and payment plans aren’t cutting it, step up your game with a formal demand letter. This isn’t just another email—it’s a serious, written request for payment. It tells the client you’re not playing around.

Actionable Tip: Make sure to include:

- The total amount due

- A deadline for payment (7-10 days)

- Potential consequences if they don’t pay (like taking legal action)

Keep the tone professional but assertive. Clients often take action once they realize the situation is escalating.

4. Consider Hiring a Collection Agency

If the demand letter doesn’t work, and you’ve exhausted all friendly options, it’s time to look at a collection agency. They’ll take a percentage of the payment if they’re successful, but it’s a way to get paid without involving lawyers and lawsuits.

Actionable Tip: Research reputable agencies that work with freelancers. Many agencies focus on collecting unpaid invoices from small businesses. Just make sure to weigh the cost against the amount owed—collection agencies can take up to 25-50% of the recovered funds.

5. Legal Action as a Last Resort

When all else fails, you may need to consider legal action, especially if the amount owed is substantial. Small claims court is an option for freelancers, and it doesn’t require hiring a lawyer. However, this should be your absolute last resort due to time and legal costs.

Actionable Tip: Gather all your documentation—contracts, emails, invoices—and be prepared to show proof of the agreement and the work you completed. If the client values their reputation, a simple threat of legal action can often lead to a quick resolution without actually going to court.

Taking immediate action when a freelance client won’t pay can mean the difference between getting what you’re owed and losing out completely.

Stay professional, keep communication clear, and escalate appropriately. Now, let’s make sure this never happens again by setting yourself up for success with the right protections in place.

How to Protect Yourself from Non-Paying Clients in the Future

Once you’ve dealt with a client who won’t pay, you never want to find yourself in that situation again. I’ve been there myself… The good news? You don’t have to. There are specific steps you can take to safeguard yourself and make sure clients pay on time—every time.

Here’s how to bulletproof your freelance business.

1. Always Use a Contract

This should be your first line of defense. No contract, no project—period. A well-written freelance contract not only outlines the scope of work but also spells out payment terms, deadlines, and consequences for non-payment. It’s your legal protection in case things go south.

Actionable Tip: Your contract should include:

- The scope of work and deadlines

- Payment structure (upfront, milestone, or post-project)

- Late payment penalties (like charging interest or fees)

- A clear process for resolving disputes

And don’t worry—you don’t need a lawyer to write one from scratch. Platforms like Bonsai or HelloBonsai offer contract templates tailored for freelancers.

2. Request an Upfront Deposit

This is non-negotiable, especially with new clients. Asking for 25-50% of the payment upfront shows that you’re serious, and it reduces your financial risk. If a client hesitates to pay upfront, that’s a red flag—they might not be serious about the project or paying on time.

In the many years I’ve freelanced, I always had clients sent me a deposit. I would almost never do work without one.

Actionable Tip: For larger projects, break it into milestones and ask for a deposit at each stage. For example, 30% upfront, 30% halfway through, and 40% upon completion. This keeps cash flow steady and makes sure both parties stay committed.

3. Use Professional Invoicing Tools

If you’re still sending invoices through email or PDFs, it’s time to level up. Using invoicing software like QuickBooks streamlines the process and offers additional perks like tracking payments, setting up reminders, and even sending automated late fees. Plus, it gives you documentation in case of a dispute.

Actionable Tip: Set up automated payment reminders so you never have to manually chase down late invoices. Many platforms will also let you schedule recurring invoices for long-term clients.

4. Charge Late Payment Fees

Most clients will pay on time if they know there’s a financial penalty for being late. Including a late payment clause in your contract adds urgency. Something like, “A 5% fee will be added for payments more than 7 days late.” Clients don’t want extra charges, and this motivates them to settle up faster.

Actionable Tip: If you have a client who regularly pays late, remind them of the late fee clause during your next conversation or invoice. This alone can speed up future payments.

5. Communicate Payment Terms Clearly from the Start

Miscommunication is one of the biggest reasons for non-payment, so you need to set expectations upfront. Make sure your client knows exactly how much they owe, when they owe it, and how to pay you. Don’t leave room for ambiguity.

Actionable Tip: Include your payment terms in every proposal and follow up with them in an email once the project begins. Reiterate the due dates and payment method, so everyone is on the same page.

6. Break Larger Projects into Milestones

If you’re working on long-term projects, get paid along the way by breaking the project into smaller milestones. This helps you avoid working for months and waiting for one massive payment at the end. Milestones ensure you get paid incrementally and help the client manage their budget.

Actionable Tip: Define clear milestones in your contract. After each milestone is completed, send an invoice for that specific portion of the project. This keeps the client engaged and makes payments more manageable.

By following these steps, you’ll protect yourself from non-paying clients and ensure that every project comes with clear terms and guarantees. Freelancing doesn’t have to feel risky—set up these systems, and you’ll never worry about chasing down payments again.

What to Do If Non-Payment Becomes a Habit

Sometimes, despite your best efforts, certain clients just never seem to pay on time. It’s not just frustrating—it’s a threat to your business. If late or missed payments are becoming a pattern with a client, it’s time to step back and evaluate whether continuing to work with them is worth the hassle.

1. Have an Honest Conversation

Before you cut ties, have a straightforward conversation with your client. Sometimes they might not even realize the impact their late payments are having on you. Explain that timely payments are crucial to keeping your business running and see if you can reach a solution.

Actionable Tip: Use this moment to set new payment terms. For example, if they consistently pay late, suggest switching to upfront payments or shorter payment windows (e.g., 7 days instead of 30). You can say something like, “To keep things efficient for both of us, I’d like to switch to a shorter payment cycle moving forward.”

2. Enforce Late Fees

If they’ve agreed to your contract and still refuse to pay on time, don’t be afraid to enforce late fees. This may sound tough, but late fees exist for a reason—to protect your cash flow. If the client keeps ignoring deadlines, it’s time to put that clause into action. Sometimes, the financial pressure of accumulating late fees is enough to get them to start paying on time.

Actionable Tip: When sending a late invoice, clearly outline the additional fees incurred and make sure they know the total balance due. This adds urgency to the situation and often leads to quicker payments.

3. Consider Dropping the Client

At a certain point, if a client consistently refuses to pay or is always late, it may be time to cut your losses. No amount of income is worth the stress of constant non-payment issues. The time and energy you spend chasing payments could be better spent finding new, reliable clients.

Actionable Tip: If you’re ready to move on, do it professionally. Let them know you won’t be able to continue the relationship due to non-payment and that you need to prioritize clients who respect your terms. This leaves the door open for future business if their situation changes, but it also protects your time and sanity.

4. Leverage Reviews and Referrals

If this non-payment pattern persists, you might want to consider protecting other freelancers by leaving an honest review or filing a report with freelance platforms like Upwork or Freelancer. On certain platforms, clients with bad reputations are flagged, and this helps other freelancers avoid similar issues. Just be sure you’ve exhausted all your options before going this route.

Actionable Tip: Don’t go straight to leaving a negative review. Always try to resolve the issue directly first. If all attempts have failed and they’re not responsive, then consider leaving a review or report that sticks to the facts and outlines the payment issues.

5. Replace Problematic Clients with Better Ones

Use non-paying clients as a wake-up call to improve your overall client screening process. Set higher standards for new clients and look for red flags before you begin a project. Clients who respect your work and your payment terms will be willing to meet you halfway.

You can watch my video on how to get freelance copywriting clients which can be applied to any service.

Actionable Tip: In your initial conversations with potential clients, look for any hesitation around payment terms. If they push back on deposits or avoid the topic of contracts, that’s a huge red flag. Walk away before you waste time with someone who’s likely to create more payment headaches down the road.

Ultimately, if a client is causing too much stress or consistently fails to pay, it’s time to rethink the relationship. Prioritize clients who value your work and respect your payment terms—because there are plenty of businesses out there who will.

Freelancers’ Rights and Legal Protection

Let’s get real—sometimes non-payment escalates, and you need to protect yourself legally. It’s crucial to understand your rights as a freelancer, especially since you don’t have the same protections that traditional employees enjoy.

Knowing your legal options not only helps you get paid but also deters clients from taking advantage of you in the first place.

1. Know Your Rights as a Freelancer

Freelancers often fall into a gray area in terms of legal protection, but that doesn’t mean you’re powerless. In many places, freelancers have legal avenues to pursue unpaid invoices.

For example, New York’s Freelance Isn’t Free Act protects freelancers and mandates written contracts for work worth over $800. The law also allows freelancers to claim double damages if they’re not paid within 30 days.

Actionable Tip: Research freelancer protection laws in your city or country. Know the deadlines for payments and legal recourse available to you. In the U.S., cities like New York are leading the charge in freelancer rights—check if your location has similar protections.

2. Small Claims Court as a Last Resort

Small claims court is an option if you’ve exhausted all other avenues. The process is relatively straightforward, and you don’t need a lawyer to represent you. In fact, most small claims courts deal with amounts ranging from $1,000 to $10,000, which is perfect for unpaid freelance invoices.

Actionable Tip: Document everything—emails, contracts, invoices, and any correspondence with the client. Bring this evidence to court to strengthen your case. Be prepared to pay a small filing fee, but in many cases, the court will order the client to reimburse you if you win.

3. Use Freelance-Friendly Legal Services

Legal action doesn’t always have to be time-consuming or expensive. There are affordable services that cater specifically to freelancers. Platforms like Freelancers Union or LegalShield offer legal protection and advice at affordable rates. These services can help you draft legal demand letters or even represent you in disputes.

Actionable Tip: Sign up for a freelance legal protection plan that fits your budget. For instance, LegalShield offers access to legal advice for as little as $24.95 per month, and they can send demand letters on your behalf, making the whole process faster and more affordable.

4. File a Lien for Larger Projects

If you’re working on a big project—especially in industries like design, construction, or even tech—you may be able to file a lien against the client’s business. A lien gives you legal claim over the work or project you’ve completed until you’re paid. This is a more aggressive route but can be highly effective in ensuring you get what’s owed.

For example, one of my good friends recently did some freelance contracting for a home developer. They stiffed him out of $25,000! He placed a lien on the property and was able to get his money back.

Actionable Tip: Speak with a legal professional to see if your project qualifies for a lien. Make sure you file it properly, as mistakes could invalidate your claim. It’s a solid last resort if you’re dealing with a significant amount of unpaid work.

5. Enforce Contracts with Binding Arbitration

If your contract includes an arbitration clause, you may be able to resolve the dispute outside of court. Binding arbitration is a less formal process where both parties agree to have a neutral third party settle the issue. The decision made by the arbitrator is legally binding, which means the client must comply with the outcome.

Actionable Tip: When drafting contracts, include a binding arbitration clause. This gives you an enforceable, legal option if the client refuses to pay. It’s faster and less costly than traditional legal action, but still ensures a formal resolution to the payment dispute.

By understanding your rights as a freelancer and leveraging legal protection when needed, you take control of the payment process. Don’t shy away from legal action when you’ve done the work and deserve to get paid—just make sure you have the right tools and services backing you up.

The Importance of Clear Payment Terms in Your Contracts

If you want to avoid chasing payments and dealing with non-paying clients, one of the most critical steps is to establish clear payment terms before you even start the project. Vague or poorly defined terms are a recipe for disaster. You need everything outlined upfront, in writing, so there’s no room for misunderstanding.

Let’s break down why this matters and what you should include.

1. Define Payment Schedules

One of the most common reasons for late payments is unclear schedules. If you’re not telling clients when to pay, don’t expect them to do it on time. Should they pay upfront? 50% now and 50% on delivery? Set the terms clearly in your contract, so there’s zero confusion when the invoice lands in their inbox.

Actionable Tip: Use specific payment terms like “50% deposit due before work begins, and 50% due within 7 days of final delivery.” Don’t just assume the client knows when payments are due. Be explicit about the deadlines.

2. Establish Late Fees

Late fees are a great motivator. Clients are much less likely to drag their feet when they know every day costs them extra. A small penalty, like 1.5% of the invoice total per month of delay, can push clients to pay faster. Make sure these penalties are in the contract so there’s no arguing about them later.

Actionable Tip: Add this clause to your contracts: “A 1.5% late fee will be added to unpaid invoices every 30 days past the due date.” This way, you have leverage if the payment doesn’t come through on time.

3. Outline Payment Methods

This may seem basic, but specifying how you’ll get paid can prevent delays. If a client is scrambling to figure out how to send you money, you’ve already lost precious time. Tell them upfront what payment methods you accept—whether it’s PayPal, bank transfer, or another platform.

Actionable Tip: List payment methods in your contract and invoice. Example: “Payments can be made via PayPal, bank transfer, or credit card. Bank transfer details will be provided upon request.” This keeps everything simple and eliminates excuses.

4. Use Escrow for Larger Projects

For high-value projects, consider using an escrow service. This way, the client deposits funds into a third-party account before you start working, and you get paid once the project is complete. It adds a layer of security and ensures that you’re not left high and dry after putting in weeks or months of work.

Actionable Tip: Platforms like Upwork and Freelancer have built-in escrow services, but you can use independent ones like Escrow.com for off-platform projects. This guarantees the money is there when the project is finished.

5. Include a Kill Fee

What happens if the client decides to cancel halfway through a project? You need a kill fee clause in your contract to cover the work you’ve already done. Without it, you risk putting in hours of work and getting nothing if the client backs out.

One time I had a client cancel a copywriting project half-way through. We negotiated that I would keep the deposit as I had already completed approximately half of the work. Don’t be afraid to stand up for yourself and get paid for your effort, despite cancellation.

Actionable Tip: Include a clause like this: “In the event of project termination before completion, a kill fee of 50% of the total project cost will be due.” This protects you financially if a client pulls the plug unexpectedly.

How to Build Strong Client Relationships to Avoid Payment Issues

Most payment issues come from a lack of communication or trust. You can have the tightest contract in the world, but if the relationship is off, there’s still a chance you’ll be chasing payments.

Building a strong relationship with your clients from day one can go a long way in ensuring smooth, on-time payments. And it’s not just about being “nice”—it’s about setting the stage for respect and professionalism that encourages timely payments.

1. Set Expectations Early

One of the biggest mistakes freelancers make is being unclear about how they work. If you’re not upfront about payment timelines, project deadlines, or the review process, you’re setting yourself up for problems. Early in the conversation, clarify your payment terms, your process, and what the client can expect from you in terms of delivery.

Actionable Tip: Include a “process overview” document with your proposals that outlines payment milestones, the scope of work, and how feedback will be handled. This takes the guesswork out of the equation and puts everyone on the same page from the start.

2. Communicate Frequently

Regular communication keeps projects moving and prevents misunderstandings that can lead to disputes over payment. Clients get frustrated when they’re in the dark—so don’t leave them there. Provide consistent updates on your progress and check in regularly, even if everything’s going smoothly.

It shows professionalism and reinforces that you’re serious about the project, which makes them more serious about paying you.

Actionable Tip: Set a schedule for check-ins based on the project’s length. If it’s a short-term project, send a mid-project update. For longer projects, consider weekly or bi-weekly updates. Tools like Trello or Slack make it easy to stay connected without clogging up your email.

3. Build Trust with Quick Turnaround Times

Trust is the foundation of any freelancer-client relationship. One of the easiest ways to build that trust is by delivering your work on time—or even ahead of schedule. When clients see that you consistently meet deadlines, they’ll be less hesitant to release payments on time.

Actionable Tip: Always under-promise and over-deliver. If you think a project will take five days, tell the client seven. When you deliver it in five, you’ve exceeded their expectations and earned trust points. This also gives you buffer room in case something comes up.

4. Make Payment Easy

Make it as easy as possible for clients to pay you. Some freelancers unintentionally create friction by not offering flexible payment options, which can delay the payment process. Always clarify your payment preferences upfront and, if possible, provide multiple payment options.

Actionable Tip: Offer multiple ways for the client to pay you—PayPal, credit card, bank transfer, etc. Use invoicing tools like FreshBooks or Stripe that allow clients to pay directly with a click. If it’s easy, they’ll pay faster.

5. Be Professional but Personable

Here’s a fact: clients are more likely to pay on time if they like working with you. That doesn’t mean you have to become best friends, but showing some personality and being pleasant to work with can make a big difference.

When the relationship feels transactional, clients might feel less urgency about paying. When it feels like a partnership, they’re more inclined to treat you fairly.

Actionable Tip: Don’t be afraid to show some personality in your communication. Be polite, but also human. Ask how their day is going, or comment on something personal if the opportunity arises. Building rapport keeps things smooth and professional, and makes late payments less likely.

Wrapping Up How to Deal With Non-Payment as a Freelancer

Non-paying clients are a frustrating reality in the freelance world, but you don’t have to accept it as part of the job. You can take control of your business and protect your income by setting clear payment terms, requiring deposits, and using the right tools to streamline invoicing.

Sure, contracts and late fees might sound formal, but they’re what separates a professional freelancer from one who constantly chases down payments.

Always vet your clients before taking on work, and trust your gut if something doesn’t feel right. If a client starts showing red flags—like pushing back on deposits or dodging contract details—it’s time to reconsider working with them.

The key here is to build solid relationships with the right clients and create processes that ensure you get paid on time.

At the end of the day, freelancing is a business. You deserve to get paid for your work, just like any other professional. Put the systems in place that make non-payment impossible, and you’ll spend less time chasing clients and more time growing your business.

You can get mentorship from me and access to all of my paid programs inside the Marketing Pro Academy. Consider enrolling if you’re serious about growing your freelance business and more.